Property Clearance Sale on the Horizon? – 5 Sep 2013

=====================================================================================

In yet another sign that property sales are slowing and all is not too rosy, property developers are dangling rental guarantees to entice buyers sitting on the fence.

To explain, a rental guarantee means the developer gives you certainty of rental income for a predetermined period, for peace of mind. This can range from 2 to 5 years. The longer the rental guarantee period, the more risky the project. This saves you the headache from securing a tenant but it also means that if the developer manage to find a tenant and make a yield of 6%, you only get 4% if 4% was the yield guaranteed. Always read the fine print and see what you are getting. If the rental guarantee allows you to enjoy the upside, then it’s of course a better deal for you.

Apparently, at Icon@Pasir Panjang, developed by Fragrance Realty, a 5 per cent rental guarantee is being dangled. We’ve not been there but would make a trip there soon to see if it is a good deal or not. Our recent due diligence trip to Icon@Changi, a similar and recently TOP(ed) commercial office/retail project revealed an interesting finding. We’ll share our findings in the upcoming outreach on the 14 Sep (Sat)!

(Property) Development Plans for Singapore – 25 Aug 2013

==========================================================================================================

Our Prime Minister’s National Day Rally on 18 Aug, which covered Singapore’s future land use development held a clue how Singapore will “try” to accommodate the “stretch target” of 6 million by 2020 and 6.9 million by 2030. (I’ll be in my 50’s by then)

Essentially, we’ll be freeing up 2 sizeable tracts of land.

First, about 800 hectares of land to be freed from relocating Paya Lebar Airbase to Changi East . This is the equivalent of about 2 more Jurong East housing estates. This would help to provide anywhere between 250,000 to 300,000 residential housing as the new flats (public) and private developments slated to go up would most probably be skyscrapers and height control restrictions lifted for adjoining areas. See below.

Second, by relocating our Tanjong Pagar Port from Tanjong Pagar to Tuas West, another 1000 hectares of land will be released. This is the equivalent of a Choa Chu Kang New Town and a Toa Payoh New Town. This future Southern Waterfront City will probably accommodate 300,000 to 350,000 residential housing.

This is the fastest way Singapore will be able to provide housing options for a projected population of 6 million by 2020 from our current population of about 5.3 million.

But hey, the numbers don’t quite stack up. The ports lease will only expire in 2027 before they are shifted and the relocation of Paya Lebar Air Base will only happen in stages over the next two decades and start in earnest only after 2030.

Hence, how are we really going to house the projected increase in population of another 700,000 in 7 years time? The lack of urgency could mean that the government is going easy on the population target of 6 million by 2020 and 6.9 million by 2030.

There will a property supply glut hitting the market in 2014/16 and that could cater to some extent to the projected increase in population (provided the government is still committed to its population vision). I advise those who have bought properties to rent out as an investment to be mindful that the rental you should expect is not what you want but what your potential tenant can reasonably afford. Better to have a rented unit than an empty one, rite?

Our Best, Always!

The Residential Property Correction – 07 Aug 2013

====================================================================================================

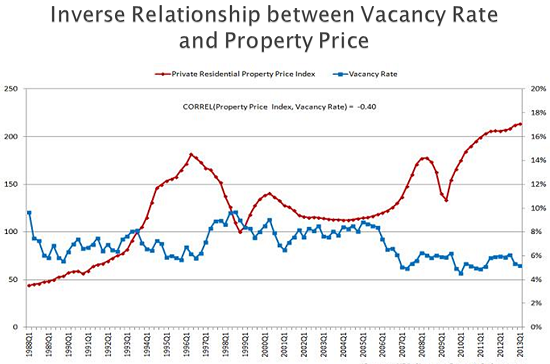

For those who like me have been waiting by the sidelines, your patience will soon be rewarded. Let’s first go to basics. In the chart above, it is clear that whenever property vacancy rate is high, property price goes the other way.

And what have we been hearing from the ground? Yes, you have guessed it, or even anticipated it. Landlords, these days are being forced to lower their rental asking price as the bumper crop of condo units supply is flooding the local property market, increasing vacancy rate. This was also reported in the Straits Times on 1 Aug 2013. It won’t be long before some of these landlords barely covering their mortgage payments, are forced to make some hard decisions when interest rates start to increase. Will you have enough cash to seize the opportunity when the bargain property deals start to emerge? Even if you do, do you know which ones to scoop up? Come on to our course to find out.

Our Best, Always!

The 2 Rm HDB game changer – 1 Aug 2013

===================================================================================================================

Finally, finally, finally, single Singapore citizens aged 35 years and above, who are first-timers and earning not more than $5,000 a month can buy a new 2-room HDB flat direct from HDB! They can do so on their own under the Single Singapore Citizen (SSC) Scheme or with other single citizens under the Joint Singles Scheme (JSS). As my focus is on singles who want their own privacy and not have to share it with another single, the focus of my analysis is on those who purchase it under the SSC for their own stay.

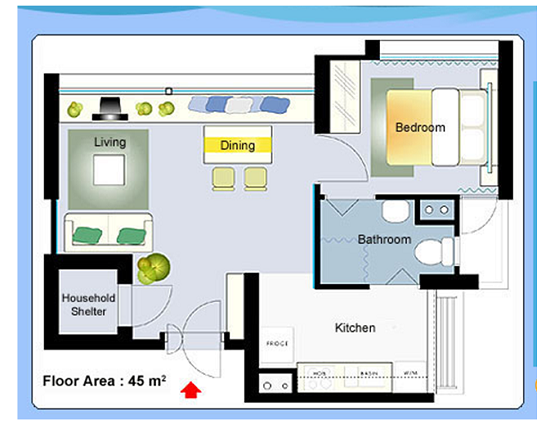

With a family of 4 occupying a typical area of 90 sq m (4 room flat), the 45 sq m area for a single occupier is fair by any measure. And hey, those earning not more than $2,500 a month can enjoy further discounts. See the table below.

Grants for Singles under the Single Singapore Citizen (SSC) Scheme

|

Income

|

Total Grant

|

|---|---|

| Up to $750 | $30,000 |

| $751 to $875 | $25,000 |

| $876 to $1,000 | $22,500 |

| $1,001 to $1,125 | $17,500 |

| $1,126 to $ 1,250 | $15,000 |

| $1,251 to $1,500 | $12,500 |

For those who have bought private studio apartments of similar sizes for investment, their pool of potential local buyers will shrink as more single Singaporeans are hampered by the recent restrictive loan framework (here to stay for the next few years, at least) and eventually accept the idea of paying 70% less for an equivalent 99 yrs leasehold property, albeit in a less convenient non-mature HDB estate. But with Singapore developing as it is today, how long can a non-mature estate remain so?

Singles who buy a new 2-room HDB flat from HDB will eventually have to pay half the prevailing resale levy for a subsidised 2-room flat when they subsequently buy a second subsidised flat. However there is no stopping a single from buying a private property eventually once he/she fulfills the minimum occupation period (MOP) of 5 years. This means assuming the flat takes 3 years to construct, and another 5 years of MOP, the individual has 8 years to invest in the stock market and build up his/her retirement fund. This is possible because the outlay of a 2-rm HDB flat is low, allowing the individual to have more spare cash to invest in good stocks in the stock market. How to do it? Sign up for our course and find out!

Our Best, as Always!

Property buying curbs in Asia – 18 Jul 2013

==================================================================================================================================================

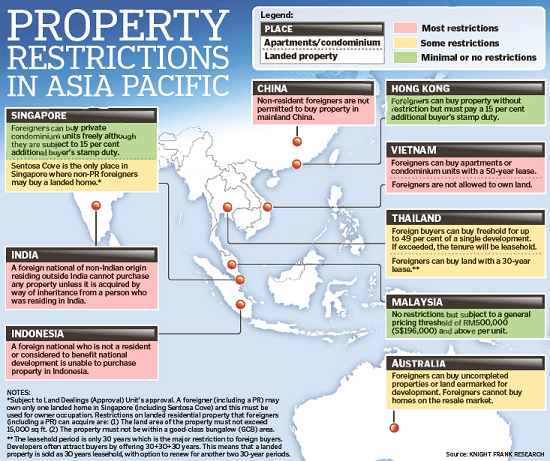

It’s not just foreign property buyers feeling the heat in Singapore. It’s happening all over Asia as confirmed by Knight Frank recently. If you have been following the news of late, you would have guessed as much.

Hong Kong has adopted property buying curbs similar to those in Singapore, ruling that foreigners must pay a stamp duty of 15 per cent on the purchase price.

Rising property prices in Iskandar in Malaysia have led the Johor state government to implement higher taxes on foreigners owning properties by end 2013. In Vietnam, foreigners can buy apartments or condominiums with a 50-year lease but are not allowed to own land. But ehh,,,Vietnam? I’ll skip that country for now.

In China, only foreigners who have worked or studied there for at least a year can own a home for their own occupation. The list of Asian countries with such restrictions on foreign property buyers go on.

Any safer haven? Well, accordingly, restrictions are less severe in Thailand, where foreign buyers can acquire freehold apartments in up to 49 per cent of a development. In Australia, non-resident foreigners can buy uncompleted property or even land earmarked for development.

How does one make sense of it all? There is always a time and place for everything. Perhaps, sunny skies are shifting away from property and shining more favorably upon the stock market. Anyone game to join me?

Our Best, Always!

Iskandar Malaysia – Data please? – 27 Jun 2013

==================================================================================================================================================

Where are the facts on Iskandar Malaysia?

Everyone these days seems to be saying, “Let’s go to Iskandar for our sure-win property investments!”

Agents are sprouting anecdotes about prices jumping in highly sought after areas such as Medini and Danga Bay. The question is where are the hard verifiable figures?

In Malaysia, as a real estate practitioner, you can access data compiled by the Valuation and Property Services Department, a government agency, through its website – Jabatan Penilaian and Perkhidmatan Harta (JPPH) but presto, there is nothing much to be found about Iskandar property market statistics.

I have no idea if any property agents and consultants in Singapore actually keep track of sales volumes and price trends there. For me, I rely on my contacts in Malaysia to give me info on the ground. What to do, as there is no such Malaysian equivalent of our Urban Redevelopment Authority’s website to check on any amount of information, including the number of homes sold in a particular development last month and transacated prices among other information.

And the best part is, few developers publish official statistic information on their projects. Don’t you feel frustrated if you want to monitor property trend? The lack of good quality property information about Iskandar only facilitates people with vested interests to cherry-pick anecdotal data to talk up the market.

I’m not alone who take that stand. CBRE Malaysia’s associate director of estate management Kevin Goh said that unscrupulous agents and developers sometimes use the information gap to make false claims about their properties.

For example, marketers may claim that the project is 80 per cent sold and selling fast when the real number might be closer to 30 per cent.

Hopefully, when Iskandar matures and the sub-sale and resale markets are more established, good quality information will be more easily available. That will make it harder for touts to make inflated claims.

Without access to common property comparables like psf and rental yield, buying an investment property in Iskander is as good as buying a car without test driving it.

Our Best, Always.

Iskandar Malaysia – Everyone’s raving but … – 27 Jun 2013

D’Esplanade Residence @ KSL City Brochure Picture

==================================================================================================================================================

With all the news on numerous Singaporeans buying homes in Iskandar, one would have thought that the past reputation of uncompleted homes, abandoned projects or delays in completion haunting Malaysia is gone.

But it appears not to be.

Just recently, a mixed development project consisting of hotel, shopping mall and residential units KSL D’Esplanade Residence, minutes away from the Causeway found itself in the limelight after irate buyers complained of delays to the press.

Buyers say that they were given conflicting information on the completion dates of the project.

Here’s what the developer said – “The 80 per cent completion rate cited in 2011 referred to the lower floors and that “every floor has a different completion date. But projects first get three years unless you apply for an extension, which we did not plan for. If we had applied for the extension to five years, this year would have been the fifth year, and we’d be in time to complete the project.”

The firm said the sales and purchase agreement begins only on the date of purchase, not the day which construction started, meaning every buyer’s three-year duration started at a different date.

That’s not all. According to the brochures, the hotel would have an 18-hole mini-golf course but buyers found out later it had been replaced by a water theme park. An exasperated Singaporean buyer commented, “I did not buy the unit to stay next to a wonderland.”

Ouch! So the completion date of the project is a moving target. And the sales brochure is a magician spell book. Just look at the brochure picture vs the project in progress. Do they look the same?

Don’t forget your due diligence.

Our Best, always

What’s brewing in Philippines? – 11 June 2013

How does gross rental yields of up to 10 to 12% sound to you?

When I was in Manila last year on a due diligence trip, I saw sky scrapers rising, packed malls and lots of folks hanging around purposefully. Finally, helmed by a more honest and reform-minded President Benigno Aquino III, affectionately known as Noynoy, a cleaner and better government is attracting more foreign investments and creating the stable investment climate that is conducive to a surging property market. Unfortunately, according to current Philippines constitution, one can only serve as the president for 6 years. With 3 more years left in his tenure, one hopes his eventual successor can keep up the momentum in the long journey ahead.

So what’s driving demand?

1) IT-related support activities such as call centers and business process outsourcing (BPO) firms have boosted demand for rental housing. Some estimate that the Philippines will overtake India by 2015 as the hub for BPO. Already, some Singapore companies have located backroom functions to the Philippines.

2) Remittance from 10 million Overseas Filipinos. How much is the total remittance worth? About USD23 billion in 2012, according to World Bank estimates and 60% of these remittances go directly or indirectly to the real estate sector, especially into the low-end to mid-range residential housing projects in regions near Metro Manila. The strong local demand support and the fact that most of them take very little loans from the banks (high interest rate) means that there is no frothy bubble building up on the back of cheap loans (think Singapore!)

However, with vacancy rates as high as 12 to 15% in some parts of Metro Manila, one must still be very careful when choosing a property investment, whether it is commercial or residential.

Before we go Yayy, let’s do it, consider some of these must-know

To buy a Philippine property as a foreigner,

1) You can buy a condominium unit on your own, if not more than 40% of the building is foreign owned

2) You can buy the property through a Filipino spouse

3) You can buy through a company incorporated in the Philippines with at least 5 shareholders, out of which 60% must be locals

4) You have an investment/Special Retirement Visa for long term stay foreigners

Main Taxes you’ll be subjected to upon Purchase

1) VAT-10%

2) Document tax (aka Stamp Duty) – 1.5%

3) Transfer tax – 0.5%

4) Registration fees – 0.25%

5) Rental income tax (where applicable) – 5.13%

Main Taxes you’ll be subjected to upon Disposal

1) 6% of Gross Selling Selling Price or Market Value

So, if you are intending to buy and rent out a Philippines condominium, what is your true rental yield?

The next trend after the “outlaw” of shoe box units – 1 Jun 2013

Apparently, younger people now want homes near shops, and developers are responding.

Recent launches such as The Midtown and Midtown Residences in Hougang and NeWest on West Coast Drive, at the former Hong Leong Garden Shopping Centre site have been well received. Freehold mixed development Novena Regency (55 residential units and 45 commercial units), on the old Novena Ville site, is expected to launch before June to strong response too.

Another mixed-use site on Yishun Avenue 9 could be launched within the next few months. The hotly contested 99-year leasehold site was won by Chip Eng Seng’s CEL Property with a top bid of $212.1 million.

With high psf retail spaces cleverly marketed as unaffected by increased additional buyer stamp duties and onerous seller stamp duties, it is no wonder developers are jumping on the bandwagon. It makes sense to purchase a retail unit if you are experienced in running a retail business and the walk in traffic justify the high psf. But if you just hope to rent it out, be sure to do your sums and make a calculated decision.

Robust property sales in first week of June – 7 Jun 2013

The buying frenzy appears unabated as buyers snapped up newly launched homes and commercial units in a mixed development.

The Jewel @ Buangkok, a City Developments Limited (CDL) project moved pretty well. KAP Residences in King Albert Park and Liv on Sophia near Dhoby Ghaut also did well.

However, do note that only 208 out of 280 released units of Jewel @ Buangkok were snapped up. There are another 400 to go at the project priced at about $1,150 per sq ft (psf), higher than the average resale price ($1,070 psf) of The Quartz, which is next door.

Brisks sales at KAP Residences indicate that mixed-use (commercial/residential) developments are popular. The freehold development in District 21 is near household name schools like Methodist Girls’ School and National Junior College. According to Oxley, a mickey mouse unit developer, 93 of the 107 commercial units released were sold at an average price of $5,446 psf, while its flats went at an average price of $1,705 psf. This brought the total number of units sold at the project to 228.

Meanwhile Punggol continues to be flooded with condo launches. 512-unit Punggol executive condominium (EC) Ecopolitan by China-based property developer Qingjian Realty is expected to launch in late June while e-applications for a Sing Holdings EC near the Coral Edge LRT station (also in in Punggol), is expected at around the same time.