Pricing shocker at Puteri Harbour, Iskandar, Malaysia – 26 Sep 2014

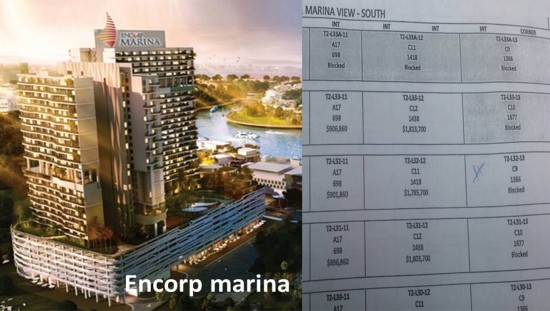

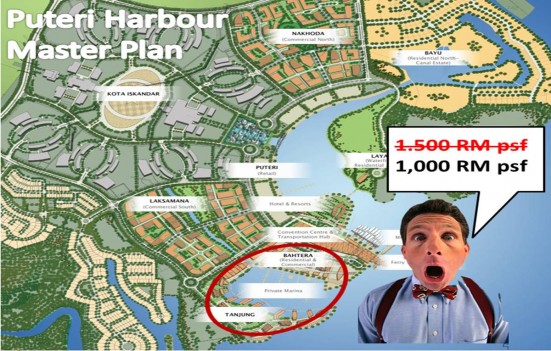

In light of the property slowdown in Iskandar, the latest indicative RM1,000 psf launch price for the latest launch Southern Marina at Puteri Harbour, Iskandar had some investors gasping for oxygen.

This is because just prior to this, another project at Puteri Harbour, The Puteri Cove had launched “sea view” units, priced at between RM1,300 to RM1,450 psf and marina view” units at between RM1,500 to RM1,600 psf.

Because The Puteri Cove registered sluggish sales, the Southern Marina developers did not want to suffer the same fate.

As mentioned before, it’s hard to access caveat data of property transactions in Iskandar. One usually has to rely on an array of developer’s indicative price list to get a sense of where the price is going.

Interestingly enough, I managed to dig out an old price list of Encorp Marina. I had been interested to buy a marina/sea fronting unit back in 2012 but as the better units were blocked for sale, leaving only the ones at the lower floors, I walked away. A quick look at the price list showed that prices for the better units were going for about RM1,250 psf. Hence, prices have indeed corrected since 2012.

Country Gardens which launched 9,600 units for sale in Danga bay still has about 60% of inventory stuck. Guangzhou R&F Properties, which has launched 3,000 units for sale in Tanjung Puteri recently had its credit rating downgraded to BB-, as it is not expected to hit its sales target.

For those who have bought into Iskandar, be mindful of the latest pricing development there. Most projects won’t be completed until 2016/2017 and already some developers have issued delay notice to buyers. If you haven’t already profited by flipping your Iskandar property, be prepared to hold on for an extended period.

Douglas Chow

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

============================================================

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

What’s the Max PSF of an Exec Condo (EC)? – 2 Sep 2014

Now that the government has announced plans for a revamped, revitalized Jurong, the latest Executive Condominium (EC) to hit the Jurong area, Lake Life is riding on the positive sentiment to launch sometime in Sep/Oct 14

One Empower Advisory member asked, “What is the highest possible price that an EC could launch at?”

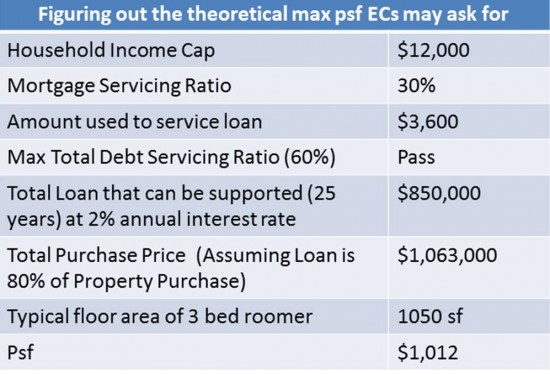

Well, in theory, there is no limit. If Lake Life could launch at $10,000 psf knowing that that it can sellout all its units at that price to Singaporeans, it will. However, because it is constrained by HDB rules such as the household income ceiling of $12,000 and restriction of sale to foreigners, Lake Life cannot be priced too crazily. It has to consider if the market, made up of mostly Singapore households can afford it.

When we went about a backward calculation to derive a maximum psf based mainly on the income and loan restriction imposed by the government, we made a reasonable assumption that the typical family unit to buy an EC is not very cash-rich and just have enough cash and cpf to service the 20% downpayment and stamp duty. We are also mindful not to stretch the loan to 30 years and use an unreasonably low mortgage interest rate. Also, ECs are not like your typical private condos for they have selling restrictions. This has a downward effect on EC pricing.

If you look at the table below, you’ll see that we have derived a MAX selling price of $1,012 psf.

Gasp! That’s crazy. Surely it won’t be?

Don’t fret! That’s just the maximum psf we calculated. We are confident it won’t hit this level because ECs have to cater too to households who are not quite at the fringe of the income ceiling.

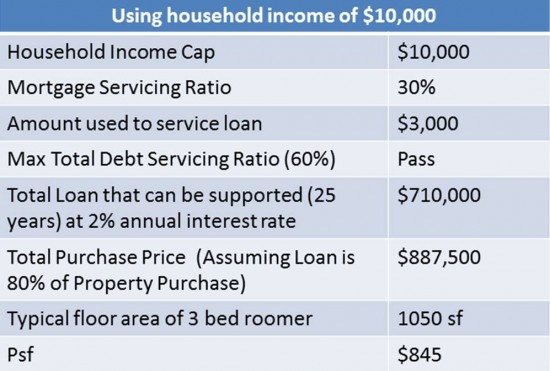

Since households earning income above $10,000 are not eligible for brand new HDBs, let’s use the $10,000 mark to re-compute the psf. We get $845 psf as shown in the table below. This is the point that EC developers think the Singapore market can reasonable bear for EC projects. It doesn’t mean however that every unit at Lake Life will clear at $845 psf.

Let’s examine the story from the developer’s end to see if $845 is palatable. The consortium behind Lake Life paid $419 psf per plot ratio for the land. Factor in about $280 psf for construction, finance and marketing cost, we derive a breakeven price of about $699 psf. Selling at $845 psf gives the consortium a 21% profit before the magnifying effects of financial leverage. Is it good enough?

Given the boost of the National Day Rally which covered the transformation of the Jurong Lake district, we suspect the consortium will push for more, perhaps up to $900 psf. If it cannot move as many units as it would like, there is more than enough fat for a price cut.

Is Lake Life a good buy then? That, you would have to ask us =)

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

============================================================

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

Gloom at Sentosa Cove, Where’s Mr DJ? – 29 Aug 2014

1) Many houses complete with private yacht berths and swimming pools sit empty in Sentosa Cove. Nearby, the apartment blocks that overlook the marina show few signs of life.

2) The last profitable transaction was made last year in Nov when a 9,225 sq ft landed property at Treasure Island was flipped for a $7.3 million profit after it was sold at $24.1 million. It had been purchased just 3 years ago.

3) Since then, as far as we could check, all transactions in this “Monte Carlo” island have been transacted at a loss. The biggest loss chalked up in 2014 was $3.2 million for 14, Treasure Island.

4) Why not just hold on to the properties, instead of off-loading at a loss, you may ask. The truth is that in Sentosa Cove, the rentals you can get is usually not enough to cover your mortgage. If every month you have to top up with cash, it’s not such a pretty situation. Some Sentosa Cove owners have reached their limits. That is why we are seeing more Sentosa Cove properties put up on the auction block by lenders. In July, a four-bedroom apartment in Sentosa’s Turquoise condo sold at auction for S$3.88 million in a mortgagee sale, or about S$1,400 psf. In 2007, a flat in the same block could fetch up to S$2,800 psf.

5) To further support the observation that high net worth individuals are feeling the heat, United Overseas Bank, in July, reported a doubling in its bad debt charges, saying a group of investors was struggling to service high-end property loans.

6) The Financial Investor Scheme (FIS) that allowed foreigners with a global net worth of S$20 million to become permanent residents if they parked S$5 to $10 million in Singapore, S$2 million of which could be put into property, has been scrapped. This scheme ran for 8 years, from 2004 and was a catalyst in foreign high net worth individuals snapping up properties here and take up permanent residence in Singapore.

7) The FIS has not been revived and we conclude that the profitable flipping party at Sentosa Cove is over for now. It’s anyone’s guess when the music will re-start but it’s safe to assume the DJ is going to be away for an extended break.

Our Best, Always

Share our postings, be our Facebook Ambassador and win prizes!

============================================================

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

Local promoters of EcoHouse projects, What Say You? – 15 Aug 2014

For investors still clinging on to the hope that their investment in EcoHouse’s projects in Brazil is still safe, it just got worse.

Up to 1,500 Singapore investors have invested up to S$70 million in EcoHouse projects. It is not known how many of them actually got their money back.

The Brazilian Embassy in Singapore confirmed yesterday that it had no prior knowledge of the existence of EcoHouse’s operations in Brazil. The embassy also found that there was “no record of any agreement with any company bearing the name ‘EcoHouse’ related to ‘Minha Casa, Minha Vida’ (Brazil’s national housing programme), or any other federal programme”.

Yet on its website, EcoHouse claims that it was chosen by the Brazilian government as “the only UK company to date officially authorised to build developments under Minha Casa, Minha Vida.”

Who to believe?

1) First, take a look at this slick YouTube Video by EcoHouse

2) EcoHouse had promised a 20 per cent fixed rate of return for a 12-month investment contract with a minimum outlay of S$47,810, but many Singaporean investors have not received their returns or their capital despite their contracts reaching maturity.

3) Most recently, it closed its 42nd storey rented office at Suntec Towers 2.

Why Empower Advisory DID NOT encourage anyone to invest or introduce anyone to EcoHouse projects

| First Sense | Does it stack up? |

| The logic and risk of the EcoHouse projects in Brazil | We were not able to verify the claims of EcoHouse nor its promoters. Recourse action if things go wrong is murky and not well understood.

Promised 20% returns a year do not make sense when the developer can borrow in Brazil and partners for less than that and pocket more profits for itself. For its low-cost social housing, will the Brazil government really allow a private developer to make so much margin from low cost social housing that EcoHouse can afford to give investors 20% return within a year? Returns to early investors could most easily come from later investors similar to a pyramid scheme. |

| Marketing efforts of EcoHouse | Why we were not overly impressed |

| Reported International Development Awards that EcoHouse won | We’re in this industry long enough to know that such awards can be bought and even staged. |

| Slick YouTube Videos | Surely the videos have to be attractive to loosen your wallets and purse. |

| Swanky Address | EcoHouse Group's office on the 42nd storey of Suntec Tower Two is rented. The money came from early investors? |

| Regular investor/chill out meetings at its office

EcoHouse invites via Eventbrite |

Just a way to build rapport and get more investors in through word of mouth marketing by earlier investors. |

| Reports of buying frenzy at their launches | Again, we’re in this industry long enough to know that buying behavior can be manipulated by planting staff within the audience to pretend to sign up and buy.

Other tricks such as having staff (planted or not) tell the audience like, “Oh my laywer friend invested too, my doctor friend invested also, breaks down the defence of many people. Unsavvy investors start thinking, “Even doctors and lawyers invest, surely the project is ok and I can’t be wrong." |

| Extensive coverage and Exclusive interviews with local website Property Guru. Investor meetings introduced by Property Guru’s journalist | For a long while, a lot of good stuff about EcoHouse was reported by Property Guru. And we’re not sure if Property Guru verifies any of those claims by EcoHouse before publishing them.

Some folks might think, if what EcoHouse claims on Property Guru is reported, it must be true? Not us. |

| EcoHouse set up booth in SMART Expo 2013 in Singapore at MBS 28-29 Sep | Anyone can set up booth at SMART Expo. It’s just marketing. It's not a sign of credibility. |

| EcoHouse theme of being social conscious and be part of a meaningful programme to build sustainable low cost social housing in Brazil | Just a way to tug at heartstrings. Remember people with no verification asking you to donate to a worthy cause. And you don’t even know how real it is? |

| Some early investors reportedly got their 20% return with capital | Similar to a pyramid scheme, it could be structured such that early bird gets the worm to entice other birds and provide buffer to continue the payout. We cannot verify how many investors actually got their returns + capital back. |

However, our harshest words are reserved for local promoters who got Singaporeans into this investment. They know who they are and if you are a stuck investor, you know who they are.

1) What was more important to you? Your commission?

2) Did you not consider the risk of the projects by EcoHouse that we considered and firmly declined any involvement in?

3) Did you care that Singaporeans could lose their hard earned savings?

4) What kind of independent due diligence did you do? Did you even do any?

5) Have you been honest with the investors you bought into EcoHouse investments?

6) Are you involved in any of the smoke screen and mirrors?

Your investors you brought in need and deserve answers.

It is a very painful experience for many Singaporeans stuck in this investment. That is why we must stand up and warn those around us about promoters who introduce such hurtful investments and projects. We have also exposed some smokescreen and mirrors tricks commonly used The more we speak up, the less folks will get hurt in future and learn to be more careful with their money.

Our Best, Always

Share our postings, be our Facebook Ambassador and win prizes!

============================================================

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

What you need to know about Lofts – 28 July 2014

=================================================

In July, condominium developer, Macly Assets lost a bid for damages of about $760,000 from a couple whom it claimed had built two unauthorised lofts in their 60 sq m penthouse apartment at Thomson V Two, a smallish mixed development where mickey mouse apartment were sold with a high ceiling.

The developer had blamed the couple for its delay in obtaining the certificate of statutory completion from the Building and Construction Authority (BCA). The $760,000 damages was for lost opportunity cost, as the delay meant that a sum of $5 million, paid by the flat buyers and held in a stakeholding account, was tied up longer than it should have been.

However, the High Court, found that Macly Assets had given written permission for the timber lofts to be built. The couple however had to spend money to modify their loft to adhere to building regulations.

Do you know exactly what you can build as lofts in a high floor to ceiling height unit?

Loft concepts are how some developers and agents try to sell you projects, swaying you with the argument that you can build extra living space at a minimal cost and lower your overall PSF. Yet sometimes, details are not given in earnest.

Lofts designed as furniture decks are generally regarded as “fixtures” if they are light-weight and do not form part of the structural elements of a building. They should be small and about the size of a normal bed (less than 5m2). When designed this way, they will not require planning permission from URA. Building Plan and Structural Plan approvals by the Commissioner of Building Control are also not required. However, the developer/owner is to check to ensure that the addition and usage of the loft or intermediate floor deck would not exceed the designed load capacity of the unit.

Bigger lofts (more than 5m2) that form part of the structural element of the building, such as mezzanine floors, are considered part of the GFA of the development and will require planning permission from the URA, including Building Plan and Structural Plan approvals by the Commissioner of Building Control. Some of you might have seen huge loft in showrooms used as study areas

If the site has already fully maximized its allowable gross plot ratio (GPR) as stipulated in the masterplan, the additional loft structure will NOT be allowed by the authorities.

So be wary when you see a showroom with a loft concept where the loft is a large space that can accommodate more than just a normal bed. It is not a given that that approvals will be granted by the authorities when you want to build one.

Developers and agents, please be fair to buyers. It may just be a hit and run transaction for you, but buyers will have to regretfully live with a misled purchase.

Our Best, Always

Share our postings, be our Facebook Ambassador and win prizes!

============================================================

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

Priced to Fail. Bet Against Us? – 21 Jul 2014

============================================================

On 17 July 2014, Spring Grove condominium, located in Grange Road was put up for enbloc sale at $1.39bn, translating to $2,512 psf per plot ratio.

This is despite a unit in the development fetching only a maximum of $1,800 psf in Oct 2012.

You cannot build anything shabby on that plot. It has got to be a high end condo to justify the high price tag that a typical buyer has to pay.

Now that would mean construction cost of about $600 psf and a breakeven price for the developer of about $3,100 psf. Perhaps, instead of demolishing the existing condominium, the developer may try to cut cost by simply refurbishing it so it looks brand new.

Appetite for high end-condos in the Core Central Region (“CCR”) where Spring Grove condominium is located has weakened, as shown in the latest quarterly drop of 0.5% in price index for non-landed properties in the CCR.

Why then did the marketing agent for the en-bloc not advise the owners to cool their expectations and be more realistic about the asking price? One can only guess that if the marketing agent had done so, it would not have been engaged to market the enbloc sale.

The billion dollar question then is, will the enbloc transact successfully at the asking price.

A quick scan of 14 nearby comparable condos (comprising complete and uncompleted developments) registered only a maximum of $2,292 psf (transacted selling price) in the most recent 6 months, a 26% discount to our estimated breakeven price of $3,100 psf. And we were using the highest transacted price. If we had used the median transacted price, it would have been a whopping 34% discount to the estimated breakeven price.

We don’t think the deal will go through at $1.39 bn. We deem it overly ambitious in today’s climate. Who wanna wager against us?

Our Best, Always

Share our postings, be our Facebook Ambassador and win prizes!

============================================================

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

So you want to be a retail space landlord? – 9 July 2014

=================================================

1) It’s tough being a brick and mortar retailer these days. Just ask FJ Benjamin, struggling with aggressive industry-wide discounting, rising rentals and manpower shortages. Most recently, FJ Benjamin registered a quarterly loss of $5m on the back of a $90m sales turnover. F J Benjamin retails and distributes exclusively brands such as Banana Republic, GAP, GUESS?, RAOUL, BELL & ROSS and GIRARD-PERREGAUX among many other upmarket brands. You must have seen many of their stores in shopping malls and here lies a big headache for FJ Benjamin (considered a small retail tenant). Rising rentals.

2) REITs retail landlords charge their tenants a base rent and a percentage of gross turnover. Small tenants are typically charged a higher base rent than the larger tenants. A small tenant may be paying up to $40 per square foot per month (psf pm) on Orchard Road compared to up to $20 psf pm paid by a large tenant. Like in most things, size matters.

3) Smaller tenants are also typically locked into short lease agreements with landlords – meaning that their rents are up for renegotiation (usually upwards) every 1 to 3 years, while anchor tenants typically have their leases renewed every 10-20 years.

4) Why are we highlighting such practice by REITs landlords? Before you get carried away and decide that you also want to be a retail space landlord and squeeze the life out of your tenant, think again. These REITs landlords are able to do so because they control entire retail complexes which are located in areas of heavy footfall, traffic and supporting amenities.

5) If you are a standalone (strata titled) individual retail unit landlord, you are not a REIT and will not have such a draconian hold over your tenant. Remember that. That landlord next to you can just lower the rent to swing your potential tenant over.

6) With more than 600 new strata shops in mixed development projects coming up in a couple of years, we think you should be cautious. Already at our outreach, we have highlighted completed retail space projects that are ghost towns where landlords are struggling to find tenants and pay their mortgages. Some of these units are of mickey mouse sizes that no tenant in his right mind will pay good money for. For many of such strata retail units, their location and customer catchment area is a problem. It’s no surprise then that some of these units were recently sold off at a loss. There is only so much bleeding some ill-advised investors can stomach.

7) Be careful when considering to buy strata-titled retail spaces. If in doubt, you can contact us at Empower Advisory for a second opinion.

Our Best, Always

Share our postings, be our Facebook Ambassador and win prizes!

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

Bleeding at Sentosa Cove while the waves roll by – 30 Jun 2014

=========================================================================

One might think that the well-off are immune to poor investment decisions. Really? Interesting enough, about 2 out of every 5 Sentosa condominium units resold within the past year had been transacted at a loss.

HSR Research revealed that resale prices in Sentosa had fallen from about $2,400 psf over the Jan-May 2013 period to about $1,800 psf in the first five months of this year.

Two units in particular made pretty hefty losses. A 2,982 sq ft unit at The Oceanfront sold for $5.65 million ($1,895 psf) on 26 Nov last year, after it was purchased in Apr 2008 for $7.2 million ($2,415 psf) – a $1.55 million loss. Ouch.

Another one at The Coast sold for $4.8 million ($1,702 psf) in 6 Dec 2013, after it was purchased at $6 million ($2,128 psf), registering a $1.2 million loss over 2 years.

More recently, a unit at The Berth was sold at a loss of $315,000 on 10 Apr 2014. Nobody likes to sell his property at a loss. The owner must have been driven to a tight corner before having to resort to selling in a weak market.

More Sentosa properties are also being put on the mortgagee auction block. Recently, a 2,777-sq-ft unit at Turquoise condo, put up as a mortgagee sale by a lender at a Colliers’ auction received no interest despite shaving $1 million off its previous opening price of $5 million.

It’s important to get your timing, financing and strategies right in property investment. Losing money is very real.

When Douglas gets his RES license in a couple of weeks, he will be able to represent folks in property transactions. This was not the intention when he founded Empower Advisory. But witnessing people get hurt and misled into less than ideal property investments and decisions made him decide that it’s the right thing to do, so less folks will make bad property decisions.

Very soon, as a seller or buyer of property, you can engage Douglas to represent you in property transactions and provide you with the advice you deserve.

Stay tuned!

Our Best, Always

Share our postings, be our Facebook Ambassador and win prizes!

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

Is it time to celebrate Property Christmas early? – 11 Jun 2014

===========================================

Prices of property projects in general are on their way down. The question on everyone’s mind now, is how much more?

Wheelock Properties managed to offload another 95 units of The Panorama, a 99 yrs LH mid-tier condo in Ang Mo Kio after slashing prices by about 12%. The project is not even half sold since its launch 6 months ago, so the developer is not exactly celebrating yet.

City Developments fared better, managing to move 63% of 944 units at Coco Palms in Pasir Ris since its launch on 17th May 2014. Three-bedders start from $880,000 and four-bedders start from $1.21 million, at an average $980 psf, below the “magical” $1000 psf floor. The lower quantum, made securing a loan easier. No prize for guessing that all one bedroom apartments have been sold.

Developers are adjusting to the new reality and pricing their projects to sell. We sense that the cooling measures will not be lifted for some time yet. This is even though Monetary Authority of Singapore managing director Ravi Menon had recently said that property measures may not be permanent and will only be used from time to time,

Runaway property prices was a huge grouse in the 2011 election and nearing the next coming election in late 2015 or 2016, it is unlikely that the authorities would want 3 years of cooling measures come undone so soon. The aim is to gradually bring property prices to a more sensible level the government has done a great job in this respect.

More affordable property will also be beneficial to businesses who have complained about the squeeze they face from unreasonable rental and property prices. This further reinforces, in our view, the authorities’ reluctance to remove cooling measures so soon.

So will you celebrate Christmas early? Or wait a while more?

Our Best, Always

Share our postings, be our Facebook Ambassador and win prizes!

[Property Update] Tears and cautious YAYs – 20 Apr 2014

====================================================

====================================================

It’s time to take out your toughest mask and ask for a discount. Not that developers are not expecting it. They are already cutting prices to pry open your wallet. Savvy readers who have been following our property postings already know. So here’s a quick update.

Remember Sky Habitat, which has been mentioned in Empower Advisory’s bimonthly outreach and case studies? This morning, you would have seen a full page ad pricing smaller units (1 bedroom + study) at $1,372 psf and 3 bedroom units from $1,267. Just when early buyers of Sky Habitat thought it won’t get any worse when Capitaland launched adjacent Sky Vue at lower psf prices, the price cut is now at Sky Habitat itself. On paper, early buyers of Sky Habitat might already be staring at a loss. There is no need to wait for official figures to be released by URA to confirm that property prices are coming down. Sharp observers like Empower Advisory with its nose on the ground has sussed that out long before.

Why the price cut, you may ask. Sky Habitat launched in Apr 2012 still has 64% of units unsold to date. That is a compelling reason enough in light of the stagnant buying sentiment in the residential property market.

Patience with knowledge is a virtue and we hope like us, your patience is paying off. Before this ad was placed today, transacted prices at Sky Habitat were between $1,428 psf (larger unit) to $1,749 psf (smaller unit). Someone even paid $1,893 psf in May 2012 for a 635-sqft Sky Habit unit. A case of exuberant optimism, excess cash or just not being very savvy? Like in our posting title, there are definately tears being shed.

Happy Shopping

Our Best, Always

Share our postings, be our Facebook Ambassador and win prizes!