Property prices creeping back to saner levels? – 6 Nov 2013

================================================================

It was in the news just a week ago. In the clearest sign of an inventory clearing exercise, The Inflora, a new condo project a short stroll from Changi Prison, a 5km drive from Tampines Mall and nowhere near an MRT station, saw close to 100% take up. The sweetener? Sub $900 psf pricing.

A week later over in Punggol, albeit less spectacular, an Executive Condominium, Waterwoods managed to move about 30% inventory with an average pricing of $800 psf.

Developers are not taking chances. Run of the mill projects have to clear ASAP. For such projects, it is too risky for developers to hold out for high prices and wait for buyers to blink. In the latest set of property statistic released by URA on 25 Oct, several interesting numbers caught our attention.

As at the end of 3rd Quarter 2013, there was a total supply of 84,917 uncompleted private residential units in the pipeline. Of this number, 36.5% remain unsold. If we include 12,436 EC units also in the pipeline, the upcoming inventory stands at 97,353 units. Buyers have choices. Lots of choices, in fact.

Let’s pile it on a little more. Another 10,025 units from Government Land Sales (GLS) sites will be added to the pipeline supply. Including these units, there will be about 107,400 private housing and EC units in the overall pipeline supply, many of which are expected to be completed in 2 to 3 years.

It is no wonder then that a concerned Real Estate Developers Association of Singapore has called on the Government to “calibrate” its land sales programme.

Vacancy rate wise, for completed private residential units, it has increased to 6.1%, up from 5.6% in the previous quarter.

We seem to be approaching an inflexion point in the private residential property market cycle. What will Q4 2013 statistics from URA reveal?

Our Best, Always!

Residential property – A 20% price correction? – 9 Oct 2013

===================================================================

In a report issued on 5th October (Fri), Barclay warned that general residential property prices could be headed for 10 to 20% correction from the peak of 1H 2013.

Their report revealed nothing new that we have not shared with our participants and members. Large oversupply coming on board in the next few years and higher interest rates is expected to drive selling pressure. Also, the 4 years seller stamp duty on residential properties would have reached its tail end by then, giving investors more motivation to offload.

Of course, the 20% drop if it happens will not occur overnight but over the next few years. Barclay forecasted that prices will stabilized/remain flat in 2013 (Yes, we are already seeing this with developers reducing/holding prices), before falling 5% in 2014 (reasonable assumption) and another 5 to 15% in 2015.

Our independent research shows that residential property prices in general over the past 2 to 3 years have advanced well over 20%. Hence a correction of 10 to 20% over the next 2 to 3 years will not be surprising. It’s just bringing us back to saner acceptable levels.

Our Best, Always!

A tale of 2 condos (Sky Habitat vs Sky Vue) – 19 Sep 2013

=====================================================================

Most recently, CapitaLand announced its pricing for Sky Vue in Bishan, about a 4 to 5 min walk from Junction 8 and Bishan MRT.

What made us sit up however was the difference in launch price. Next door “iconic” neighbor, Sky Habitat, also by CapitaLand, transacted between $1,416 and $1,810 psf, higher than Sky Vue’s launch at $1,380 to $1,550 per sq ft.

The Sky Habitat site was secured at a whopping $870 psf ppr and Sky Vue’s site was secured at about 2% less at $853 psf ppr. One might think that CapitaLand would launch Sky Vue near the same price as Sky Habitat to “protect” the interest of those who had purchased Sky Habitat earlier and maintain the selling price of Sky Habitat.

However, with Sky Habitat less than 40% sold to date after more than a year in the market, perhaps CaptaLand doesn’t want to repeat the pricing mistake it made with Sky Habitat. Remember, CapitaLand had bid overly aggressively for the Sky Habitat site, outbidding the next closest bidder by S$118m or 20% and had to pass the winner’s curse to Sky Habitat’s buyers through clever marketing. Is the “unique design” of Sky Habitat really worth the premium? As an investor, will your tenant pay you a higher monthly rental because of that?

What are the key takeaways? Developers will sell you a project at the price that the market can bear at that point of time. Buy a project at the wrong time and you could be in for a real headache. Sky Vue’s launch price at $1,380 to $1,550 per sq ft suggest that bargaining power is shifting back to buyers. Those who have been waiting patiently by the sidelines like us, well done.

Oh, don’t say we didn’t warn you. See the large open space of land adjacent to Sky Habitat and Sky Vue? That plot is currently HDB’s land and if next generation high rise HDB flats go up, there goes some of your high rise view.

Our Best, Always

Property Clearance Sale on the Horizon? – 5 Sep 2013

=====================================================================================

In yet another sign that property sales are slowing and all is not too rosy, property developers are dangling rental guarantees to entice buyers sitting on the fence.

To explain, a rental guarantee means the developer gives you certainty of rental income for a predetermined period, for peace of mind. This can range from 2 to 5 years. The longer the rental guarantee period, the more risky the project. This saves you the headache from securing a tenant but it also means that if the developer manage to find a tenant and make a yield of 6%, you only get 4% if 4% was the yield guaranteed. Always read the fine print and see what you are getting. If the rental guarantee allows you to enjoy the upside, then it’s of course a better deal for you.

Apparently, at Icon@Pasir Panjang, developed by Fragrance Realty, a 5 per cent rental guarantee is being dangled. We’ve not been there but would make a trip there soon to see if it is a good deal or not. Our recent due diligence trip to Icon@Changi, a similar and recently TOP(ed) commercial office/retail project revealed an interesting finding. We’ll share our findings in the upcoming outreach on the 14 Sep (Sat)!

(Property) Development Plans for Singapore – 25 Aug 2013

==========================================================================================================

Our Prime Minister’s National Day Rally on 18 Aug, which covered Singapore’s future land use development held a clue how Singapore will “try” to accommodate the “stretch target” of 6 million by 2020 and 6.9 million by 2030. (I’ll be in my 50’s by then)

Essentially, we’ll be freeing up 2 sizeable tracts of land.

First, about 800 hectares of land to be freed from relocating Paya Lebar Airbase to Changi East . This is the equivalent of about 2 more Jurong East housing estates. This would help to provide anywhere between 250,000 to 300,000 residential housing as the new flats (public) and private developments slated to go up would most probably be skyscrapers and height control restrictions lifted for adjoining areas. See below.

Second, by relocating our Tanjong Pagar Port from Tanjong Pagar to Tuas West, another 1000 hectares of land will be released. This is the equivalent of a Choa Chu Kang New Town and a Toa Payoh New Town. This future Southern Waterfront City will probably accommodate 300,000 to 350,000 residential housing.

This is the fastest way Singapore will be able to provide housing options for a projected population of 6 million by 2020 from our current population of about 5.3 million.

But hey, the numbers don’t quite stack up. The ports lease will only expire in 2027 before they are shifted and the relocation of Paya Lebar Air Base will only happen in stages over the next two decades and start in earnest only after 2030.

Hence, how are we really going to house the projected increase in population of another 700,000 in 7 years time? The lack of urgency could mean that the government is going easy on the population target of 6 million by 2020 and 6.9 million by 2030.

There will a property supply glut hitting the market in 2014/16 and that could cater to some extent to the projected increase in population (provided the government is still committed to its population vision). I advise those who have bought properties to rent out as an investment to be mindful that the rental you should expect is not what you want but what your potential tenant can reasonably afford. Better to have a rented unit than an empty one, rite?

Our Best, Always!

The Residential Property Correction – 07 Aug 2013

====================================================================================================

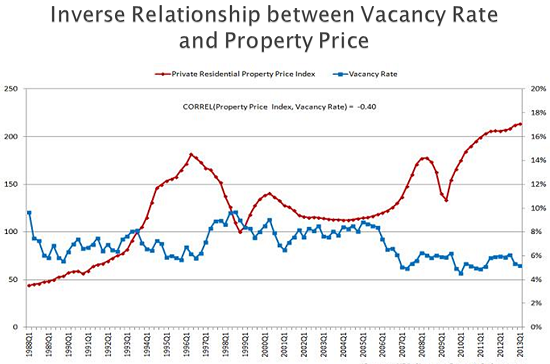

For those who like me have been waiting by the sidelines, your patience will soon be rewarded. Let’s first go to basics. In the chart above, it is clear that whenever property vacancy rate is high, property price goes the other way.

And what have we been hearing from the ground? Yes, you have guessed it, or even anticipated it. Landlords, these days are being forced to lower their rental asking price as the bumper crop of condo units supply is flooding the local property market, increasing vacancy rate. This was also reported in the Straits Times on 1 Aug 2013. It won’t be long before some of these landlords barely covering their mortgage payments, are forced to make some hard decisions when interest rates start to increase. Will you have enough cash to seize the opportunity when the bargain property deals start to emerge? Even if you do, do you know which ones to scoop up? Come on to our course to find out.

Our Best, Always!

The 2 Rm HDB game changer – 1 Aug 2013

===================================================================================================================

Finally, finally, finally, single Singapore citizens aged 35 years and above, who are first-timers and earning not more than $5,000 a month can buy a new 2-room HDB flat direct from HDB! They can do so on their own under the Single Singapore Citizen (SSC) Scheme or with other single citizens under the Joint Singles Scheme (JSS). As my focus is on singles who want their own privacy and not have to share it with another single, the focus of my analysis is on those who purchase it under the SSC for their own stay.

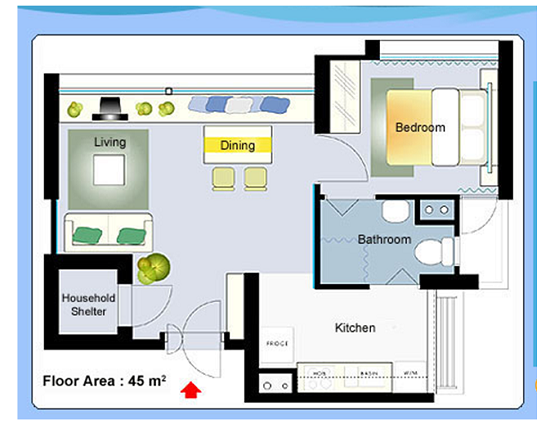

With a family of 4 occupying a typical area of 90 sq m (4 room flat), the 45 sq m area for a single occupier is fair by any measure. And hey, those earning not more than $2,500 a month can enjoy further discounts. See the table below.

Grants for Singles under the Single Singapore Citizen (SSC) Scheme

|

Income

|

Total Grant

|

|---|---|

| Up to $750 | $30,000 |

| $751 to $875 | $25,000 |

| $876 to $1,000 | $22,500 |

| $1,001 to $1,125 | $17,500 |

| $1,126 to $ 1,250 | $15,000 |

| $1,251 to $1,500 | $12,500 |

For those who have bought private studio apartments of similar sizes for investment, their pool of potential local buyers will shrink as more single Singaporeans are hampered by the recent restrictive loan framework (here to stay for the next few years, at least) and eventually accept the idea of paying 70% less for an equivalent 99 yrs leasehold property, albeit in a less convenient non-mature HDB estate. But with Singapore developing as it is today, how long can a non-mature estate remain so?

Singles who buy a new 2-room HDB flat from HDB will eventually have to pay half the prevailing resale levy for a subsidised 2-room flat when they subsequently buy a second subsidised flat. However there is no stopping a single from buying a private property eventually once he/she fulfills the minimum occupation period (MOP) of 5 years. This means assuming the flat takes 3 years to construct, and another 5 years of MOP, the individual has 8 years to invest in the stock market and build up his/her retirement fund. This is possible because the outlay of a 2-rm HDB flat is low, allowing the individual to have more spare cash to invest in good stocks in the stock market. How to do it? Sign up for our course and find out!

Our Best, as Always!

The next trend after the “outlaw” of shoe box units – 1 Jun 2013

Apparently, younger people now want homes near shops, and developers are responding.

Recent launches such as The Midtown and Midtown Residences in Hougang and NeWest on West Coast Drive, at the former Hong Leong Garden Shopping Centre site have been well received. Freehold mixed development Novena Regency (55 residential units and 45 commercial units), on the old Novena Ville site, is expected to launch before June to strong response too.

Another mixed-use site on Yishun Avenue 9 could be launched within the next few months. The hotly contested 99-year leasehold site was won by Chip Eng Seng’s CEL Property with a top bid of $212.1 million.

With high psf retail spaces cleverly marketed as unaffected by increased additional buyer stamp duties and onerous seller stamp duties, it is no wonder developers are jumping on the bandwagon. It makes sense to purchase a retail unit if you are experienced in running a retail business and the walk in traffic justify the high psf. But if you just hope to rent it out, be sure to do your sums and make a calculated decision.

Robust property sales in first week of June – 7 Jun 2013

The buying frenzy appears unabated as buyers snapped up newly launched homes and commercial units in a mixed development.

The Jewel @ Buangkok, a City Developments Limited (CDL) project moved pretty well. KAP Residences in King Albert Park and Liv on Sophia near Dhoby Ghaut also did well.

However, do note that only 208 out of 280 released units of Jewel @ Buangkok were snapped up. There are another 400 to go at the project priced at about $1,150 per sq ft (psf), higher than the average resale price ($1,070 psf) of The Quartz, which is next door.

Brisks sales at KAP Residences indicate that mixed-use (commercial/residential) developments are popular. The freehold development in District 21 is near household name schools like Methodist Girls’ School and National Junior College. According to Oxley, a mickey mouse unit developer, 93 of the 107 commercial units released were sold at an average price of $5,446 psf, while its flats went at an average price of $1,705 psf. This brought the total number of units sold at the project to 228.

Meanwhile Punggol continues to be flooded with condo launches. 512-unit Punggol executive condominium (EC) Ecopolitan by China-based property developer Qingjian Realty is expected to launch in late June while e-applications for a Sing Holdings EC near the Coral Edge LRT station (also in in Punggol), is expected at around the same time.