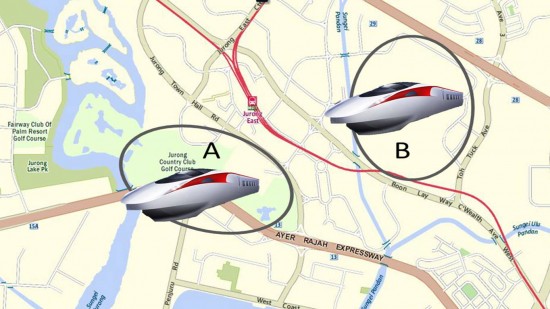

Where will the High Speed Rail Terminal (HSRT) be located in Jurong East? – 5 May 2015

As the only logical town to locate the new HSRT, the not so secret announcement that it will be located in Jurong East caught nobody by surprise. What has not been announced is the exact location

A quick study of Jurong East quickly identified two potential sites. Site A is where Jurong Country Club is located. Its lease will run out in 21 years. Taking over the plot to build the HSRT will face little resistance. Also, it’s much easier to deal with just one party for the acquisition.

Site B, bounded by Boon Lay Way and Toh Tuck Ave is another prime candidate. Currently housing several warehouse complexes and some industrial buildings, it offers a land size big enough and is further away from the residential area. We tend to favour Site B.

What is most tricky is the compulsory land acquisition that must happen before the vision becomes a reality. Having the High Speed Line up and running by 2020 is too stretched a goal. Don’t bet on it. 2025 will be a more realistic deadline.

Mall operators in Jurong East will be delighted at the prospect of holding their tenants once more ransom with the heavier footfall that should come their way. Residential landlords may fare otherwise. It’s not likely you will get more tenants renting from you just because one can now catch the High Speed Train at Jurong East. In fact the heavier crowd may just put off potential tenants from renting in Jurong East. It’s very interesting how this may play out and you’ll be sure we’ll have our eyes on the ground.

Our Best, Always!

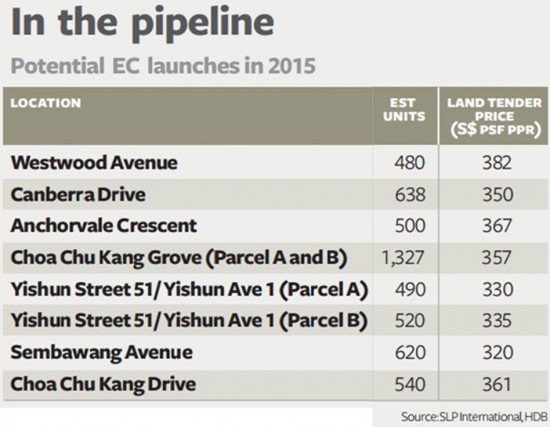

EC, EC on the wall, who’s the fairest of them all? – 4 May 2015

Looking for an EC? An additional 5,000 executive condominium (EC) units is expected to test market appetite this year.

Even without this additional new inventory coming your way, there are existing unsold units, numbering slightly more than 2,000 spread across 12 launched EC projects.

Latest data from the Urban Redevelopment Authority (URA) showed that the vacancy rate of available and completed ECs is 15.1 per cent.

Recent EC sales have not fared very well. The Amore, launched in January 15, still has ¾ of its inventory unsold. The Terrace, launched in 3Q2014 also has lots of units for you to choose from. Both projects are in Punggol.

The game changer for EC launches from this year onwards is the scrapping of second-timers’ exemption from having to pay a resale levy which can go as high as $50,000 if one is upgrading from a HDB Executive Flat. Most upgraders hail from 4 and 5 room flats and they can expect to pay $40,000 and $45,000 in resale levies respectively.

New EC launches this year will have to price units even more competitively, knowing that buyers can opt for earlier launched ECs that do not require the payment of a resale levy. Buyers, the ball is in your court.

If you can pass your total debt servicing ratio (TDSR) that caps outstanding liabilities of borrowers at 60 per cent of gross monthly income and the mortgage servicing ratio (MSR) of 30 per cent for EC units, you are essentially getting a condominium that is 15 to 20% cheaper than comparable private condominiums. The flipside is that you are subjected to stricter eligibility conditions, resale criteria and minimum occupation period. The rewards could be sweet however when your purchase becomes a full-fledged private condos 10 years after TOP.

Pricing and location will be your key considerations. City Developments’ project at Canberra Drive, adjacent to the future Canberra MRT station has fulfilled the location check list. Let’s see if City Development will get the price right down to the sweet spot.

For a snapshot of what’s in the pipeline, check out the table below.

Our Best, Always!

Do you REALLY want a property market crash in Singapore? – 8 Apr 2015

Just last week, I was having brunch with LL. She asked if the property market would correct further downwards.

“But it has already corrected 20% for some property owners,” I replied.

“Really?” she asked. “How come it’s not in the news?”

===================================================================

As if we were being eavesdropped, URA a few days later, published a study which compared residential median prices between two periods – H2 2013 and six months to end-Q1 2015; Q3 2013 was a peak for URA’s private residential property price index (PPI).

For the projects selected, the difference in median size of units transacted in the same project did not exceed 10 sq m across the two periods. This helped to ensure that the comparison is meaningful as units with different sizes fetch significantly different $psf.

In URA’s study, three residential projects cried for attention. See the picture above. Two are completed and the other is under construction. Like I pointed out to LL correctly, the downward price corrections of 20% and more that I had observed are not in the mass market condos but condo projects in the prime areas.

For some of these prime property owners, they already feel the heat of the market correction. Some have surrendered and sold off at a marginal profit or loss.

Will we then see a property price crash across Singapore?

For this to happen, a lot of things must go wrong. Very wrong. Below are some nasty scenarios working independently or together that will make such a precipitous drop a reality.

1) Terrorist attacks in Singapore

2) MNCs shift out of Singapore

3) Mortgage rates spike beyond 3.5%

4) Unemployment rate spike

5) Malaysia turns off Singapore’s water supply

6) Another global crisis

The question to ask yourself is, do you really want any of the above scenarios to happen? Because the properties that you currently own will be adversely affected too.

Our Best, Always!

Which Property Development is a Better Buy? – 7 Apr 2015

In September 2013, Fraser drew gasps from the market when it bid S$1.43 billion, a whopping 48% higher than the second highest bidder for the site that it would eventually build Northpark Residences and a mall to be integrated with the upcoming air conditioned bus interchange next door.

Fraser’s winning bid works out to be S$1,077 psf per plot ratio. It could have walked away the winner at S$733 psf per plot ratio but a lot was at stake. Losing the bid would mean that a rival’s shopping mall could choke off Northpoint Shopping Centre, the current shopping mall at Yishun Central, managed by Frasers Centrepoint Trust.

Fast forward to Apr 2015. Fraser could have launched much earlier in 2015 but it wanted to wait for 2015′s first mega residential property launch Sims Urban Oasis. Fraser needed data to understand how it should price Northpark Residences, the only component of its integrated development for sale.

As property construction costs have gone up over the past few years, there was no way it would launch at the average price of the most recent large scale integrated development, Bedok Residences, which cleared most of its units at an average price of $1,200 psf.

The breakeven price for NorthPark Residences is easily S$1,400 to $1500 psf. Selling it above that range in today’s market would be overly risky. I had expected Fraser to go for a quick sale. Cash flow is crucial to build the entire development as the bigger prize is the new shopping mall (NorthPoint City) which would add value to the group once operational, and hived into Frasers Centrepoint Trust. Selling between $1,300 psf and $1,400 psf for the residential units would move the 920 units and indeed, latest market data has shown that the prices of units sold at NorthPark Residences’ soft launch fall within this range. Selling within this range also puts it in a competitive position vis-a-vas rivals Sims Urban Oasis and Botanique @ Bartley, both of which are closer to town.

For property investors, this makes selection more interesting. All three property developments are going for between $1200 psf to $1,500psf. Which would give you the rental yield for a net positive cashflow after mortgage payment? Which would have more upside for capital gains? Which should you go for?

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

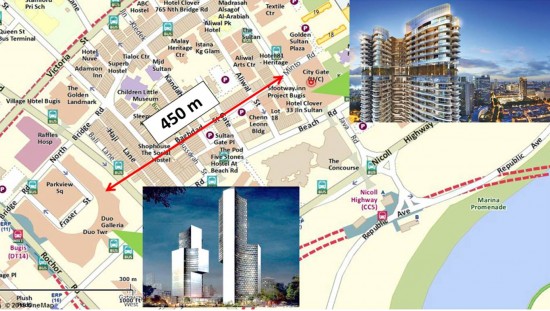

A tale of 2 cities – City Gate Vs Duo Residences (21 Mar 2015)

As the only 2 new private residential developments along the Beach Road stretch, Duo Residences and City Gate make a very compelling case study. Both are 99 yrs mixed developments and boast of a link to an MRT station. Both were launched after all the major cooling measures were implemented. Launched earlier in Nov 2013, Duo Residences, a partnership between the Singapore and Malaysian government is almost sold out to date, reaching 94%. An all-time high of S$ 2,663 PSF was recorded in Mar 2014 for a 420-sqft residential unit.

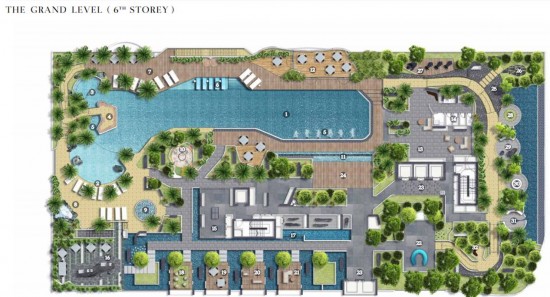

8 months later, just 450 m away, City Gate was launched. Next to the low rise, low density conservation area of Kampong Glam, it has sold 54% to date. To differentiate itself from Duo Residences, it created loft spaces in every unit except for the penthouse units. Mindful of the strong demand for city rental, the majority of its units come with a separate dual key room. To maximize the unblocked views around it, the developer created two open decks on the 6th and 24th storeys.

6th Floor Deck

24th Floor Deck

View From City Gate

As a result of these considerations and the inherent site location advantages, City Gate managed to record an all time high of S$ 2,226 PSF in Sep 2014 for a 484-sqft residential unit though this high mark was still 16.4% shy of its closest rival, Duo Residences.

Realistically, City Gate cannot hope to sell every unit at its record PSF prices. To date, the median price of City Gate’s sold residential units is $1,817 psf vs $2,010 for Duo Residences. To clear its remaining inventory, it will have to price its remaining units competitively. Thankfully for City Gate’s developer, Duo Residences is almost fully sold and their existing unit owners have no incentives to sell lower than City Gate’s prices. Neither will they want to be penalized and pay seller stamp duties for selling within a 4 years window.

To ensure price competitiveness and product differentiation, City Gate deliberately created additional loft spaces in almost every unit to give the owner an option to place an additional queen size bed atop. The majority of the units are 1, 2 and 3 bedroomers and the top floor is carved out into small and large penthouses ranging from 484 to 1,819 sq ft.

Show Flat Units

To get the latest pricing of star buy units at City Gate (lower than $1,750 psf!), just leave a message below.

Yes, I would to know City Gate’s best pricing and available units!

Why do Rich People Lose money in Property Investment? – 11 Feb 2015

1) Recently, our radar was alerted that many millions are being lost by big budget property investors who have gotten their timing wrong. It doesn’t matter if they had deep pockets to start with. Being rich doesn’t mean you always have the midas touch. Even the rich make investment mistakes.Just like Warren Buffett. Just like anyone else.

2) In any downturn in the property market, expensive luxury properties are always the first to take a big hit. This is because the pool of big budget buyers are smaller to begin with, compared to more affordable property which appeal to all savvy investors as long as the yield makes sense.

3) Even if one has the holding power, buying at the peak may mean that no matter how long you hold, the only claim to fame is that you have contributed to the highest psf ever for that particular property. It’s not exactly a record you want to show your peers unless it’s for bragging rights. Perhaps these owners have decided to cut their losses and recoup it elsewhere. We do hope to see them at Empower Advisory’s investment outreach. If not, we wish them our best, nevertheless.

4) Property is not just about location, location, location. It’s also about timing, timing, timing! Try not to cringe at the losses we have highlighted below!

ST REGIS RESIDENCES SINGAPORE

|

SOLD ON

|

ADDRESS

|

UNIT AREA

(SQFT) |

SALE PRICE

(S$ PSF) |

BOUGHT ON

|

PURCHASE

PRICE (S$ PSF) |

L0SSES (S$)

|

|---|---|---|---|---|---|---|

| 23 JAN 2015 | 33 TANGLIN ROAD #20-05 | 3,897 | 2,002 | 19 JUN 2006 | 2,872 | 3,390,860 |

| 17 JAN 2015 | 33 TANGLIN ROAD #22-09 | 4,941 | 1,923 | 17 OCT 2006 | 2,890 | 4,780,000 |

ST THOMAS SUITES

|

SOLD ON

|

ADDRESS

|

UNIT AREA

(SQFT) |

SALE PRICE

(S$ PSF) |

BOUGHT

ON |

PURCHASE PRICE

(S$ PSF) |

LOSSES

(S$) |

|---|---|---|---|---|---|---|

| 10 DEC 2014 | 31 ST. THOMAS WALK #29-01 | 4,672 | 1,552 | 29 DEC 2010 | 2,213 | 3,088,000 |

THE ORCHARD RESIDENCES

|

SOLD

ON |

ADDRESS

|

UNIT AREA

(SQFT) |

SALE PRICE

(S$ PSF) |

BOUGHT

ON |

PURCHASE PRICE

(S$ PSF) |

LOSSES

(S$) |

|---|---|---|---|---|---|---|

| 2 JAN 2015 | 238 ORCHARD BOULEVARD #36-06 | 1,808 | 3,041 | 1 NOV 2007 | 4,287 | 2,253,000 |

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

Geylang Rezoning (What it all means) – 21 Jan 2015

1) On 13 Jan 2015, URA proposed to rezone the area bounded by Geylang Road, Lorong 22 Geylang, Guillemard Road and Lorong 4 Geylang from Residential/Institution to Commercial/Institution to prevent “spillover of disamenities to surrounding areas”. This area is pretty large (affected buildings are in blue) and covers effectively most of the even numbered Geylang Lorongs where the legal meat trade outlets are located.

2) Some people rejoiced, thinking that this would mean the affected area would be eventually developed into offices and retail shops. The legal Geylang meat trade outlets will be relocated somewhere else.

3) Because I had served in the civil service, I read between the lines of a government press release.

4) If the location of a single columbarium building could cause so much angst among Singaporeans, do you think the government will risk moving an entire meat trade district somewhere else? Perhaps to Tuas or Loyang, as popular rumours have it? No way.

5) From this rezoning, it is very clear that the government intends to let the legal meat trade outlets in Geylang remain where they are, but this time with a more determined approach not to have that boundary breached. After all, the meat trade is a commercial activity and fits right into the commercial/institution classification. Today, you can see a few meat trade outlets operating beyond Geylang Lorong 22, further up towards the larger “even numbered” Lorongs. It is possible that the government will close or relocate such outlets that currently fall outside the boundary within the aforementioned boundary .

6) Quite a number of condo units within this boundary are leased out to meat trade workers. We have observed this in our due diligence around the neighbourhood. These landlords will be grinning away, knowing that there will be no increased competition from new residential developments within the boundary. In future, there will only be about 1300 to 1500 individual condo units in this boundary.

7) What could happen then is that private developers might explore enbloc purchases within the boundary to develop f & b night-life projects. Such entertainment facilities will still fit in with the meat trade industry there. Large scale office and retail developments are not likely to follow as most mainstream businesses and retailers shun a location within a meat-trade district.

8) The meat-trade may eventually be housed in high rise commercial buildings within the boundary and if successful, might then kick start urban gentrification within the boundary. However, if they remain scattered like they do now in one-storey houses, it is unlikely to happen.

Douglas

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

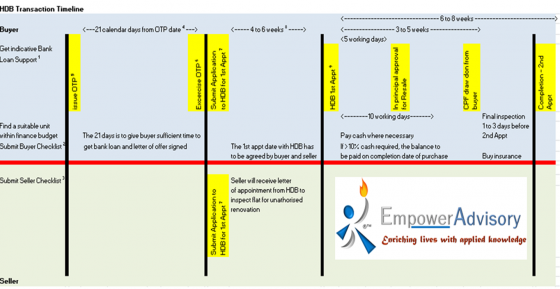

How long to complete a HDB resale transaction? – 15 Dec 2014

Many first time buyers and sellers of resale HDB flats are often surprised/shocked at the time taken to complete a HDB resale transaction. More so if they are more used to the timeline in the non-HDB private resale market where the transaction can be legally completed in a matter of 8 weeks or less from the date that the Option To Purchase is exercised. For HDB resale transactions, the time taken is typically double that, stretching up to 16 weeks.

Why so long, you might ask? Our simple response is because HDB is involved. The more parties involved in a transaction, the longer it takes. Understanding the time line is very important as you need to plan your transition to better plan your cash flow, without causing too much disruption to yourself and/or your family.

Download and save the image below to get a better grasp of the timeline and the main stages involved. If you have any questions, you know just who to ask! The Empower Advisory Team of course =)

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

Sniffing out a good property bargain – 22 Oct 2014

We looked at some property developments where there have been recent distressed sale. Not all distressed properties end up in mortgagee auctions. To put it simply, as long as the seller is forced to sell at below purchase price, it is a distressed sale. We’re giving you a headstart by providing you with a couple of developments that have seeen such distressed sales. But before you jump into it, make sure you have your finances well in place. Don’t by the next distressed property seller!

If you need further advice, feel free to contact our Principal Coach, Douglas who is also a licenced realtor. Happy Deepavali Holidays!

|

Project

|

Sold on

|

Bought on

|

Sell Price ($PSF)

|

Buy Price ($PSF)

|

Loss ($)

|

Area (Sq ft)

|

|---|---|---|---|---|---|---|

| ROBINSON SUITES |

28-Apr-14 | 27-Dec-10 | 2,273 | 2,941 | -338,000 | 506 |

| 25-Apr-14 | 27-Dec-10 | 2,250 | 2,882 | -319,500 | 506 | |

| 25-Apr-14 | 27-Dec-10 | 2,352 | 2,999 | -327,000 | 506 | |

| 25-Apr-14 | 27-Dec-10 | 2,300 | 2,979 | -343,200 | 506 | |

| WATERSCAPE AT CAVENAGH |

9-May-14 | 30-Jun-10 | 1,636 | 2,059 | -800,000 | 1,894 |

| THE GLYNDEBOURNE |

24-Apr-14 | 16-Nov-10 | 1,900 | 2,180 | -411,900 | 1,475 |

| CUBIK | 9-Jun-14 | 9-Feb-10 | 1,134 | 1,218 | -93,734 | 1,119 |

| HELIOS RESIDENCES |

12-May-14 | 27-Jun-07 | 2,781 | 3,070 | -491,450 | 1,701 |

| TURQUOISE (Sentosa Cove) |

24-Jul-14 | 2-Nov-07 | 1,450 | 2,553 | -3,064,160 | 2,777 |

| 22-Jul-14 | 2-Nov-07 | 1,397 | 2,558 | -3,225,120 | 2,777 | |

| 76 SHENTON | 11-Sep-14 | 8-Apr-10 | 1,187 | 1,661 | -459,300 | 969 |

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

What’s the Max PSF of an Exec Condo (EC)? – 2 Sep 2014

Now that the government has announced plans for a revamped, revitalized Jurong, the latest Executive Condominium (EC) to hit the Jurong area, Lake Life is riding on the positive sentiment to launch sometime in Sep/Oct 14

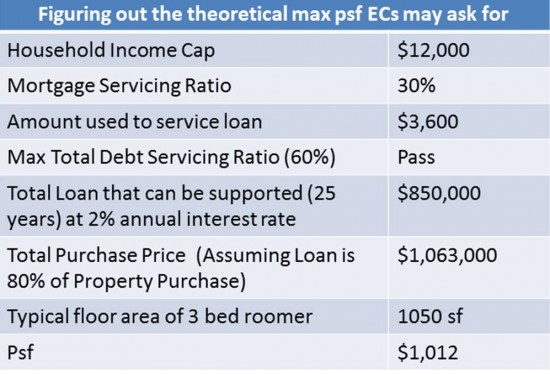

One Empower Advisory member asked, “What is the highest possible price that an EC could launch at?”

Well, in theory, there is no limit. If Lake Life could launch at $10,000 psf knowing that that it can sellout all its units at that price to Singaporeans, it will. However, because it is constrained by HDB rules such as the household income ceiling of $12,000 and restriction of sale to foreigners, Lake Life cannot be priced too crazily. It has to consider if the market, made up of mostly Singapore households can afford it.

When we went about a backward calculation to derive a maximum psf based mainly on the income and loan restriction imposed by the government, we made a reasonable assumption that the typical family unit to buy an EC is not very cash-rich and just have enough cash and cpf to service the 20% downpayment and stamp duty. We are also mindful not to stretch the loan to 30 years and use an unreasonably low mortgage interest rate. Also, ECs are not like your typical private condos for they have selling restrictions. This has a downward effect on EC pricing.

If you look at the table below, you’ll see that we have derived a MAX selling price of $1,012 psf.

Gasp! That’s crazy. Surely it won’t be?

Don’t fret! That’s just the maximum psf we calculated. We are confident it won’t hit this level because ECs have to cater too to households who are not quite at the fringe of the income ceiling.

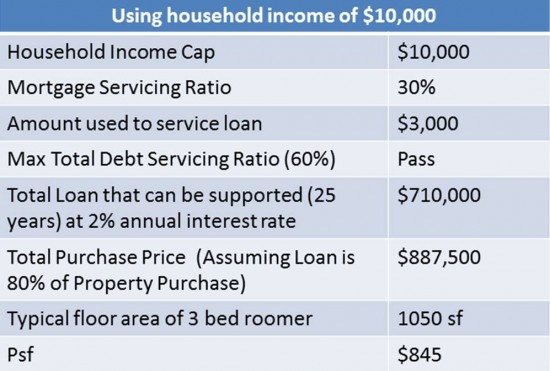

Since households earning income above $10,000 are not eligible for brand new HDBs, let’s use the $10,000 mark to re-compute the psf. We get $845 psf as shown in the table below. This is the point that EC developers think the Singapore market can reasonable bear for EC projects. It doesn’t mean however that every unit at Lake Life will clear at $845 psf.

Let’s examine the story from the developer’s end to see if $845 is palatable. The consortium behind Lake Life paid $419 psf per plot ratio for the land. Factor in about $280 psf for construction, finance and marketing cost, we derive a breakeven price of about $699 psf. Selling at $845 psf gives the consortium a 21% profit before the magnifying effects of financial leverage. Is it good enough?

Given the boost of the National Day Rally which covered the transformation of the Jurong Lake district, we suspect the consortium will push for more, perhaps up to $900 psf. If it cannot move as many units as it would like, there is more than enough fat for a price cut.

Is Lake Life a good buy then? That, you would have to ask us =)

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

============================================================

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!