Gloom at Sentosa Cove, Where’s Mr DJ? – 29 Aug 2014

1) Many houses complete with private yacht berths and swimming pools sit empty in Sentosa Cove. Nearby, the apartment blocks that overlook the marina show few signs of life.

2) The last profitable transaction was made last year in Nov when a 9,225 sq ft landed property at Treasure Island was flipped for a $7.3 million profit after it was sold at $24.1 million. It had been purchased just 3 years ago.

3) Since then, as far as we could check, all transactions in this “Monte Carlo” island have been transacted at a loss. The biggest loss chalked up in 2014 was $3.2 million for 14, Treasure Island.

4) Why not just hold on to the properties, instead of off-loading at a loss, you may ask. The truth is that in Sentosa Cove, the rentals you can get is usually not enough to cover your mortgage. If every month you have to top up with cash, it’s not such a pretty situation. Some Sentosa Cove owners have reached their limits. That is why we are seeing more Sentosa Cove properties put up on the auction block by lenders. In July, a four-bedroom apartment in Sentosa’s Turquoise condo sold at auction for S$3.88 million in a mortgagee sale, or about S$1,400 psf. In 2007, a flat in the same block could fetch up to S$2,800 psf.

5) To further support the observation that high net worth individuals are feeling the heat, United Overseas Bank, in July, reported a doubling in its bad debt charges, saying a group of investors was struggling to service high-end property loans.

6) The Financial Investor Scheme (FIS) that allowed foreigners with a global net worth of S$20 million to become permanent residents if they parked S$5 to $10 million in Singapore, S$2 million of which could be put into property, has been scrapped. This scheme ran for 8 years, from 2004 and was a catalyst in foreign high net worth individuals snapping up properties here and take up permanent residence in Singapore.

7) The FIS has not been revived and we conclude that the profitable flipping party at Sentosa Cove is over for now. It’s anyone’s guess when the music will re-start but it’s safe to assume the DJ is going to be away for an extended break.

Our Best, Always

Share our postings, be our Facebook Ambassador and win prizes!

============================================================

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

Local promoters of EcoHouse projects, What Say You? – 15 Aug 2014

For investors still clinging on to the hope that their investment in EcoHouse’s projects in Brazil is still safe, it just got worse.

Up to 1,500 Singapore investors have invested up to S$70 million in EcoHouse projects. It is not known how many of them actually got their money back.

The Brazilian Embassy in Singapore confirmed yesterday that it had no prior knowledge of the existence of EcoHouse’s operations in Brazil. The embassy also found that there was “no record of any agreement with any company bearing the name ‘EcoHouse’ related to ‘Minha Casa, Minha Vida’ (Brazil’s national housing programme), or any other federal programme”.

Yet on its website, EcoHouse claims that it was chosen by the Brazilian government as “the only UK company to date officially authorised to build developments under Minha Casa, Minha Vida.”

Who to believe?

1) First, take a look at this slick YouTube Video by EcoHouse

2) EcoHouse had promised a 20 per cent fixed rate of return for a 12-month investment contract with a minimum outlay of S$47,810, but many Singaporean investors have not received their returns or their capital despite their contracts reaching maturity.

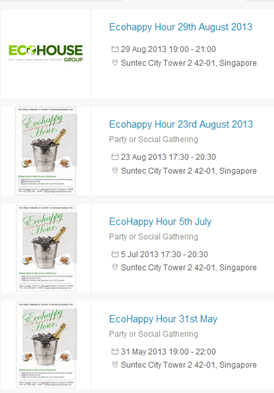

3) Most recently, it closed its 42nd storey rented office at Suntec Towers 2.

Why Empower Advisory DID NOT encourage anyone to invest or introduce anyone to EcoHouse projects

| First Sense | Does it stack up? |

| The logic and risk of the EcoHouse projects in Brazil | We were not able to verify the claims of EcoHouse nor its promoters. Recourse action if things go wrong is murky and not well understood.

Promised 20% returns a year do not make sense when the developer can borrow in Brazil and partners for less than that and pocket more profits for itself. For its low-cost social housing, will the Brazil government really allow a private developer to make so much margin from low cost social housing that EcoHouse can afford to give investors 20% return within a year? Returns to early investors could most easily come from later investors similar to a pyramid scheme. |

| Marketing efforts of EcoHouse | Why we were not overly impressed |

| Reported International Development Awards that EcoHouse won | We’re in this industry long enough to know that such awards can be bought and even staged. |

| Slick YouTube Videos | Surely the videos have to be attractive to loosen your wallets and purse. |

| Swanky Address | EcoHouse Group's office on the 42nd storey of Suntec Tower Two is rented. The money came from early investors? |

| Regular investor/chill out meetings at its office

EcoHouse invites via Eventbrite |

Just a way to build rapport and get more investors in through word of mouth marketing by earlier investors. |

| Reports of buying frenzy at their launches | Again, we’re in this industry long enough to know that buying behavior can be manipulated by planting staff within the audience to pretend to sign up and buy.

Other tricks such as having staff (planted or not) tell the audience like, “Oh my laywer friend invested too, my doctor friend invested also, breaks down the defence of many people. Unsavvy investors start thinking, “Even doctors and lawyers invest, surely the project is ok and I can’t be wrong." |

| Extensive coverage and Exclusive interviews with local website Property Guru. Investor meetings introduced by Property Guru’s journalist | For a long while, a lot of good stuff about EcoHouse was reported by Property Guru. And we’re not sure if Property Guru verifies any of those claims by EcoHouse before publishing them.

Some folks might think, if what EcoHouse claims on Property Guru is reported, it must be true? Not us. |

| EcoHouse set up booth in SMART Expo 2013 in Singapore at MBS 28-29 Sep | Anyone can set up booth at SMART Expo. It’s just marketing. It's not a sign of credibility. |

| EcoHouse theme of being social conscious and be part of a meaningful programme to build sustainable low cost social housing in Brazil | Just a way to tug at heartstrings. Remember people with no verification asking you to donate to a worthy cause. And you don’t even know how real it is? |

| Some early investors reportedly got their 20% return with capital | Similar to a pyramid scheme, it could be structured such that early bird gets the worm to entice other birds and provide buffer to continue the payout. We cannot verify how many investors actually got their returns + capital back. |

However, our harshest words are reserved for local promoters who got Singaporeans into this investment. They know who they are and if you are a stuck investor, you know who they are.

1) What was more important to you? Your commission?

2) Did you not consider the risk of the projects by EcoHouse that we considered and firmly declined any involvement in?

3) Did you care that Singaporeans could lose their hard earned savings?

4) What kind of independent due diligence did you do? Did you even do any?

5) Have you been honest with the investors you bought into EcoHouse investments?

6) Are you involved in any of the smoke screen and mirrors?

Your investors you brought in need and deserve answers.

It is a very painful experience for many Singaporeans stuck in this investment. That is why we must stand up and warn those around us about promoters who introduce such hurtful investments and projects. We have also exposed some smokescreen and mirrors tricks commonly used The more we speak up, the less folks will get hurt in future and learn to be more careful with their money.

Our Best, Always

Share our postings, be our Facebook Ambassador and win prizes!

============================================================

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!