Sell in May, Go away? S’pore & US stock market – 10 Jun 2014

=========================================

=========================================

Ever heard of Sell in “May, Go away”? Often heard and read in the media and the investment circle, it is a theory that the period from November to April inclusive has stronger growth than the other months. Hence investors are advised to sell their stocks in May since stocks generally take a tumble and pick them back at a lower price a month later or more.

What is the theory behind this phenomenon? A lot of research has been done to understand this stock market behavior. Indeed, a study published in the American Economic Review in 2002 showed that returns on stock markets in 36 out of 37 countries studied from 1970 to 1998 were higher from November to April than in the May to October period. A more recent research found that the phenomenon did indeed exist for 1998 to 2012 for major stock markets.

What could be the reason? Fund managers and individuals liquidating their positions so that they can go for their summer holidays uninterrupted? More adverse major economic and political events that seem to take place between May to October period?

In the United States, individuals get their annual capital gains distributions of mutual funds in November, and a month later, Christmas and year-end bonuses. So perhaps there is some palatable reasons why the stock market experience stronger growth between November to April. As for Singapore, maybe it takes its cue from the major stock markets and fall in line too.

But did it happen in 2014?

A quick look at the Dow Jones, Nasdaq and Straits Times index tell us that the “Sell in May, Go Away” effect did not happen, at least not for 2014. All 3 indices ended higher at the end of May than the start of the month. Some of our favourite stocks like Apple, Goodpack and Silverlake Axis continued their onward march. The takeaway is that you need to know what you are doing. Looking away just because you think everyone is dumping stocks in May means you have just missed making an early bonus for yourself.

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

SHARES

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

Clever Stock Investment (An Update) – 20 Mar 2014

========================================================

========================================================

1) Remember our posting on a Company we love, Goodpack Limited (“Goodpack”) back in 19 September 2013 (6 mths ago)? Well here’s a happy update for those who followed our call.

2) Goodpack is currently in talks with interested parties who might want to buy a major stake in the company or swallow it up whole. It’s anyone’s guess if it will really happen but based on that official announcement, Goodpack shares have shot up to $2.26, over its 19 Sep 2013 price of 1.74. For those who jumped onto the bandwagon, albeit later than us, it’s a pretty decent 30% returns (not including the 5 cents dividends announced in Dec 13) in 6 months. Which property investment can give you that?

3) That you make investments in stocks of quality companies cannot be over-emphasised. A quality company will attract corporate buyers and if Goodpack is taken private and delisted, it’s a good day for shareholders who can cash out now or later. What is bittersweet then is that they have to look elsewhere for other good companies. No worries, they are everywhere! You just need to know where to look.

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

Just buy blue chip stocks and hold, hold, hold? – 10 Feb 2014

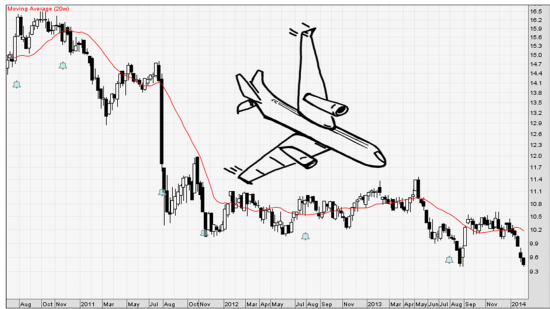

Singapore Airlines (SIA) stock performance from Oct 2010 to date

====================================================================

Some people use Warren Buffet’s name or his famous surname (Did they even get his permission??) to sell you the advice to follow what he is known to do – buy the stocks of blue chip companies and hold, hold, hold.

Hang on for a moment. Just for the records, Warren Buffet is not an ordinary retail investor. He takes so much stake in a company each time he takes a position, that he or his representative gets at least a board seat to influence the company’s strategic direction where necessary. With his deep industry connections, he helps the company to reverse its fortune or further expand its business and profitability.

You, the retail investor will not be able to do what Warren Buffet does. And if you only hear one side of the story and just blindly, hold, hold, hold on to blue chips stocks like Singapore Airlines (SIA), you’ll be a very angry and disappointed investor. Since October 2010 (see above chart), SIA has never recovered from its share price of $16 and is trading at about $9.50 today.

For a company that used to make $1b in annual profits pretty effortlessly, it is now struggling to make more than $500m, unable to grow its topline meaningfully and having to contend with overcapacity, higher operating cost and intense competition as rival full fledged and budget airlines catch up. It is a blue-black company today. Its profit margins these days are less than 5%, a far cry from its glory days.

Hanging like a dead weight around its neck is SIA’s stake in Tiger Airway which is doing badly too. The lesson here is knowing how and when to cut losses to reinvest in more profitable stocks. Having good money locked in for 3 years at a loss is a grand pity when one can use the salvaged funds to ride on other good company stocks. What’s worse is that you don’t even get a board seat in SIA to air your grievances despite being a loyal SIA stockholder!

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

SHARES

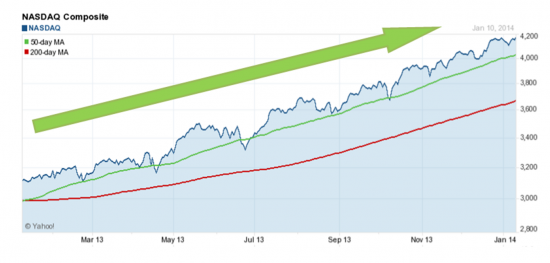

A tale of 2 Stock Markets (US vs SG) – 11 Jan 2014

=========================================================

2014 will be yet another exciting year for stock investments and good profits. No doubt the markets will be volatile and choppy and once again fraught with uncertainty with the certain tempered winding down of the US stimulus programme and the most likely scenario of a global rise in interest rate.

Sounds scary? But wasn’t 2013 also a wild yet profitable ride too? It also depends on which markets you are looking at. Let’s take a trip down memory lane and compare how the general Singapore stock market (represented by the STI) performed vis-a-vas the general US stock market for the whole year of 2013.

The Straits Times Index (STI) is regarded as the benchmark index for the Singapore stock market. It tracks the performance of the top 30 companies such as Starhub and DBS Group Holdings listed on the Singapore Exchange

The Dow Jones Industrial Average consists of 30 major American companies such as Coca Cola, MacDonalds, IBM and Intel. These companies come from a variety of industries. Do not misunderstand that this index only covers heavy industrial companies

The NASDAQ Composite is a stock market index of over 3000 common stocks and similar securities listed on the NASDAQ stock market. Some of the composite stocks are Apple and Facebook. This index is taken to largely represent the stock performance of technology companies and growth companies

What do you see and interpret?

While it doesn’t mean that you can simply make money by blindly choosing any stock in the US market and comfort yourself by saying a rising tide lifts all ships, it means that markets in different countries perform differently and give you different rewards. In this light, it is also useful to consider buying a simple exchange traded fund that track the general performance of the various stock market indicators. Yes, very boring but profitable.

We have said it before and we’ll say it again. If you have been always looking at the Singapore market and are somewhat disappointed, do consider the US stock market which has great companies and tremendous trading volume.

Recently, we took a position in Tesla after doing our homework and applying the principles we teach at our course. If you recall, we covered Tesla in our superblog posting.

We look forward to welcome our 3rd batch of Empower Advisory members this 18 January and teach a life-skill worth many, many times the course fee!

Our Best, Always!

Putting Our Investment Theory into Practice – 26 Nov 2013

==================================================

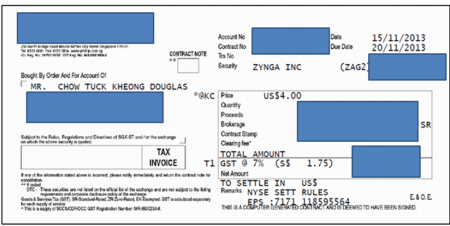

1) At the most recent outreach at Bras Basah on 23 Nov, I flashed on screen an investment position I made on Zynga on 15 Nov 2013 at 4 USD.

2) Prior to that, I had mentioned to the outreach participants that in stock investment, one must not be greedy and aim to sell at the peak. If you think like that, you will never sell but forever looking towards the next peak (If it comes).

3) On Monday, the indicators I use suggested to me that Zynga might pull back. Without second guessing, I decided to lock in a 11.25% gain by selling at 4.45USD (near its 1 yr high of 4.55). I placed my order and closed my computer.

4) The next day, I was pleasantly surprised that it closed at 4.50. Did I scold myself for not selling at 4.50? Of course not.

5) First, whoever had bought from me had made 1.1% (on paper or realized). I was happy someone else had gained too.

6) Second, I had locked in a profit of 11.25% in just 10 days in a non-speculative investment trade. (Not crazy spectacular but a happy early Christmas present nonetheless). Why did I call it a non-speculative investment trade. Zynga is no penny stock like Blumont. It is a company with more than USD1 billion in sales and develops, market and operates online social games over the Internet, mobile platforms and on social networking sites like Facebook. It is still loss making but has recently improved its performance with a management and product focus overhaul. It also has a large cash hoard to buy itself time to become profitable.

7) This is why you have to combine fundamental analysis with technical analysis to give yourself a better picture.

8) Am I still monitoring Zynga’s performance? You bet. There’s more profits to be made if you know how.

9) Once you know you can make double digit returns in a matter of days by yourself, you will never be attracted to scams that try to hook you by “promising” you 8 to 20% yields in a loooooong yr (365 days) or more.

Our Best, Always

From stock zero to stock hero and back again -10 Oct 2013

=========================================

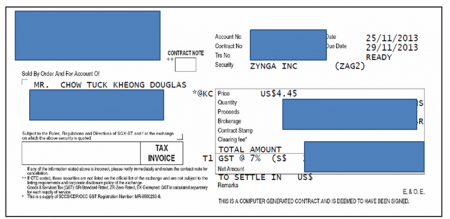

If not for Blumont Group making the news because of its spectacular fall from a Thursday’s close (3 Oct 12) of S$2.02 to 88 cents and finally to 13 cents the following Monday, we wouldn’t have known about the existence of this company listed on SGX.

What business is this company actually all about? How could it lose more than 90% in value in the space of a few days? Did the earth open up and swallow its business and employees?

A quick check on this company revealed that it has three core business segments including Investment Holding, Sterilisation and Property. Since the start of 2013, it made exuberant announcements of forays into the energy sector specifically in Iron Ore, Thermal and Coking Coal, Coking Coal, Gold and Uranium and Copper through a series of sales and purchase agreements. Imagination manifested into hopeful optimism and rocketed what was a down-beaten illiquid 3 cents penny stock back in 2012.

Those who have hopped on the bandwagon early in the stock advance, would have won bragging rights of snagging a multi-bagger. Good for you and we hope you had locked in your profits before the share price meltdown. If not, you’re almost back to square one. Those left carrying the ball after the stock price plummeted will definitely feel angry and lost. Why would Blumont not even figure on our radar? Its most recent 2Q 2013 results revealed a loss of SGD24m. Yet when this was announced on 29 July 2013, the stock continued to rocket from 94 cents to a peak of $2.54, no doubt partly on the buzz of the company’s positive announcements (no actualized profits yet). The ever ascending candlestick stock price chart with nary a break if you noticed, looked unreal to us. All in all, there are more questions than answers regarding the stock’s quick ascent and even faster collapse. SGX is currently investigating.

There are many good stocks with real underlying business and positive financials. Just yesterday, we longed a logistic company stock at 10.3 cents and are up 2% the next day by combining our usual blend of fundamental analysis with technical indicators. And yes, we are having a good night sleep over our latest investment!

Our Best, Always!

Why we bought Goodpack Limited’s shares – 19 Sep 2013

==========================================================

To Empower Advisory, investing in stocks, is about understanding the underlying company, what it does and how good it does what it is supposed to do. Take Singapore listed Goodpack Ltd for example. It was part of a list of our regular stock alert to our members.

Goodpack has a unique logistic business of owning and renting out a very large fleet of over 2.6 million steel Intermediate Bulk Containers (IBC) to transport their customers’ goods in a more efficient and cost effective way than the use of wood and corrugated packaging that is usually used one time and disposed. The IBCs are robust and specially designed to minimize damage to the goods during transportation. That is why companies who ship high value and high margin products such as automotive parts and chemicals engage Goodpack and are willing to pay a premium for its service. Ask yourself. If you are transporting premium automotive parts worth $50,000, would you risk damage using a cheaper transport solution like a typical wooden crate?

That is why we agree with Goodpack’s business. Superior delivery solution for premium clients with high value goods that require more protection and care.

The financial performance of Goodpack speaks for itself. Since 2004, the company has consistently registered net profit margin of more than 25%, BETTER than most listed companies in SGX! It has a good sensible management that is focused on business growth, has strong operating cash flow, a strong balance sheet and has chalked year on year revenue growth since 2005.

To walk the talk, I entered at S$1.52 about 1 and 1/2 mths ago and I’m up 15% today.

We highlight good companies to our members and they apply what they have learnt in our course to profit.

Empower Advisory is about real learning. That is what our Course is all about.

No scams. No nonsense.

Our Best, Always!

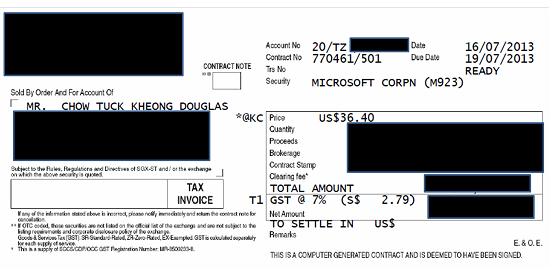

The Art of Profit Taking (lessons to share) – 19 Jul 2013

==================================================================================

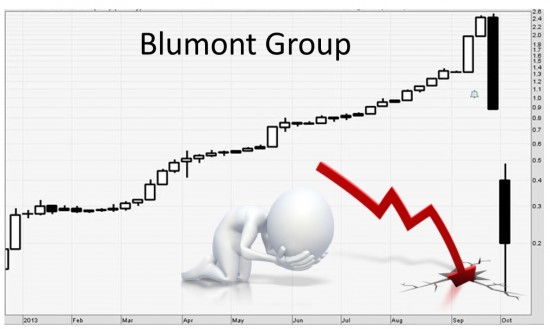

Participants at our course preview in June would have known I bought Microsoft at USD28.08 a couple of months back. After the dramatic drop in Microsoft shares following less than stellar earnings, some have asked with concern if I had exited in time.

Here is the good news. I have and the proof as usual is in the pudding. See below.

I sold off near the peak 2 days before Microsoft announced its earnings. What did I do right? Did I have insider information? It’s simple. I always keep tabs on my stock. I don’t obsess over them but I will know major news concerning them. Prior to the earnings results, Microsoft announced that it was slashing the retail price of its surface tablets by USD150. That is almost 30%. It means that Microsoft wants to gain tablet market share by sacrificing profits. While the market cheered Microsoft’s move, it worried me a little. I also suspected that it was the tip of an iceberg. Perhaps inventory of PCs were not moving very much (And hence Microsoft software) and so Microsoft had to push out its tablets faster, more aggressively.

Fundamentally, the signs to sell were there. The technical indicators looked good though. Sentiment was still upbeat for a favorable earnings report from Microsoft. And so i decided to sell into strength and sold my entire stake at US36.40 (not at the high of USD36.44 but near enough) and made about 30% profit. Not spectacular gains, but decent enough for me. I’m not greedy and hope the one who bought from me at USD36.40 will make some money eventually. If I had hesitated and not sell, I would have made only 11% profit.

Did Microsoft become a lousy company overnight? Of course not. It just didn’t meet high expectations but it is on its way to a restructured growth path. I’m now exploring if there are new entry price point for Microsoft.

My best, as Always

Where is the Singapore Stock Market headed? – 20 Jul 2013

==========================================================================================================================================================

As you can tell from the chart above, the Straits Times Index is struggling, having plummeted more than 400 points from its high this year and is currently testing the 50 days Moving Average resistance level. Whether it can break through is anyone’s guess and will depend on our corporates’ earnings report card for 2Q2013, to be released sometime in Aug/Sep.

As an investor, which sector would you focus on to pick up value buys? Would it be the traditional favorite oil and gas sector? Or would you go for the penny stocks? At this juncture, do your homework and buy into companies that have concrete growth plans and sustainable order books to tide them over the year. With the US market taking a breather after a record all time Dow Jones high of 15,542 and doing a double take on its corporates’ earnings to determine if the run up is built upon solid fundamentals or optimism, our market appears to be cautiously tracking back. It is not entirely rosy in the US. Once the very symbol of American industrial might, Detroit became the biggest U.S. city to file for bankruptcy two days ago. Although not serious enough to bring down the US economy, it suggest that US is still grappling with its economic restructuring, one that has moved jobs away from cities such as Detroit and left them with more expenses than their tax collection can cover. The US economy is not out of the woods yet. And neither is the global economy.

Our Best, Always!

Here comes the panic at the Disco – 20 Jun 2013

==================================================================================================================================================

Is the party finally over? Today, the Singapore stock market fell 2.5%, the biggest daily decline in more than 19 months in line with weakening global markets after US FED Chairman Bernanke hinted strongly that US economic stimulus will end by next year, indicating an eventual rise in interest rate level.

It’s actually good news since it means that the US economy is in better shape and Bernanke is removing the economic powerhouse from its crutches. Why then are global markets panicking? Well, nobody likes interest rates to go up especially since global economic growth is uneven with some countries even stuck in technical recession. Nevertheless, markets are once again spooked and it may be time to look for an attractive entry point.

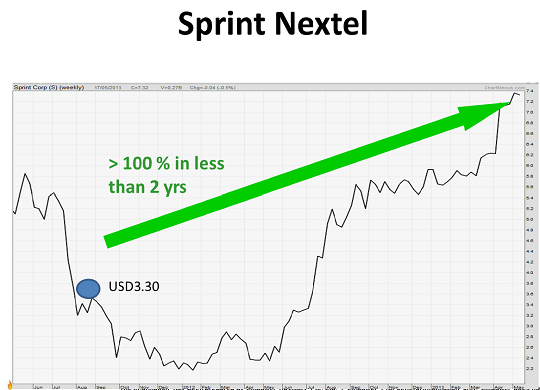

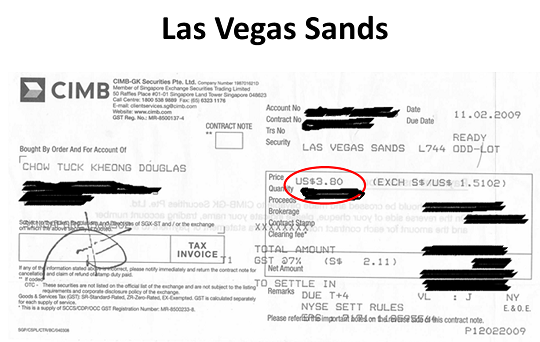

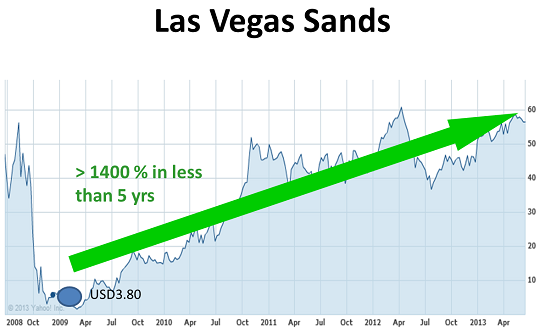

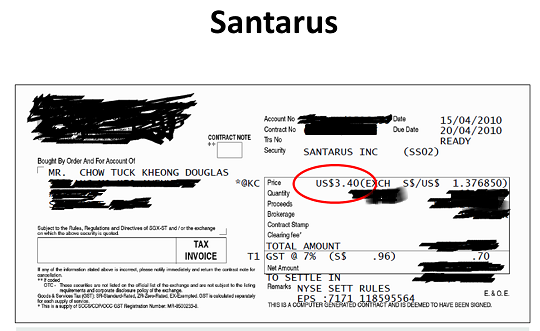

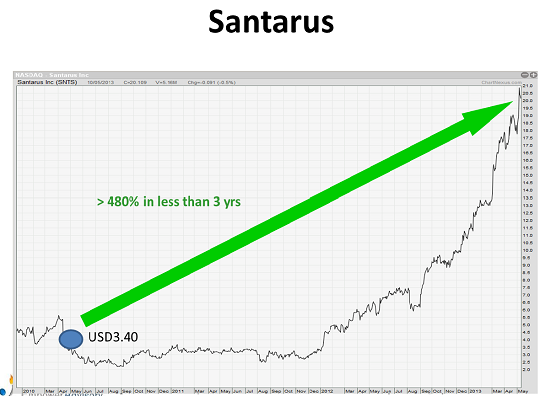

Below are the entry levels of some of my investments over the years which have benefited from panicky markets. I have no intention to show off. They are just to illustrate that multi-baggers with good companies are possible if you can sniff them out. At the seminar, I will share more of such positions with you!

Our best, always!