A roller coaster ride for the US Stock Market? – 18 Jan 2017

With one tweet, he sent Toyota shares lower. With another tweet, he sent the shares of major pharmaceutical companies lower. With yet another tweet, Boeing shares dipped. Millions of shareholder value, wiped out just like that.

Welcome to post US President Donald Trump’s US stock markets where a single tweet from Donald’s fingers, loosely connected to a brain that alternates between hallucination and facts, invites instant kneejerk reaction, whether warranted or not. It appears that no company is spared. Perhaps negative opinions on companies or sectors where he has vested interest in, will be treated more kindly.

With no bigger brand ambassador than Donald for Twitter, Twitter has scored an unintended coup. Maybe, folks who are hesitant about using Twitter will now be more willing to try this instant messaging platform. Unfortunately, Twitter is still languishing below US$20, well below its high of US$74.73. Even with the endorsement of the most powerful president in the world, Twitter still cannot convince the market of its profitability and future growth. Twitter continues to bleed quarter after quarter.

Donald’s unpredictable tweets will be the curveball you will have to live with as you stay invested in the US stock market in 2017 and beyond. No one knows if all his grand plans of bringing jobs back to US will materialize. No one knows if his protectionist rhetoric will cause the US dollar to weaken as he thinks that a stronger US dollar has been disadvantageous to US exports.

A few things are sure for 2017 though. More corporate merger and acquisition will happen, especially in the oil & gas and pharmaceutical sector. You will strike a home-run jackpot if you have shares in to-be acquired companies. Good large cap companies like Amazon and Google will continue to grow, innovate and reward shareholders. Smaller cap profitable gems are a-plenty too. Stay invested, nimble and watch out for currency fluctuations that might lower your profits should the Singdollar strengthen against the US dollar. Take profits regularly. Money ain’t yours till it’s safe in your pocket.

Whatever you do, be decisive and don’t get Terrex(ed), meaning “Stuck”.

Have an exciting year of the Rooster!

Empower Advisory Team

2015 – The Empower Advisory 6 Golden Rules for Beginner Investors/Traders

As expected, the profit taking phenomenon at year end and start of the year has ensured that the US and SG stock markets did not enter 2015 with a firework bang.

Year to date, the Nasdaq 100 and Dow Jones index dipped 1.8% while the STI lost 1.1%. The drop is mostly true for major stock indices. One of the few bright spots is the Shanghai SE Composite index which is up 2.7%.

The continual oil price collapse has claimed quite a few victims. Once popular Singapore oil play counters like Ezion and Ezra have seen their share value drop by 37% and 30% respectively in the most recent 3 months. Of course Empower Advisory members who have learnt how to cut their losses assuming they held a long position would have escaped with minimal scratches. Some could have escaped with a healthy profit. For those more seasoned traders who took a short position, you would have made your Chinese New Year Ang Bao. But my advice again. Not to nag, but don’t be complacent. Arrogance and ignorance is the reason why unsavvy, stubborn investors/traders get wiped out of the game forever.

I have cashed out of my Facebook, Yahoo and Apple holdings. Empower advisory members should have done the same since they have been very attentive in our small class hands on investment coaching.

2015 is going to be a very exciting year once again, as there will be lots of great stocks to go long and short.

===================================================

Just remember Empower Advisory 6 Golden Rules of investing/trading. Always.

Empower Rule 1) Don’t think you can control the market. You cannot. You can only control how you react to the market. Unless you’re the mastermind behind scam stocks such as Blumont, Liongold etc. Be prepared for jail though.

Empower Rule 2) Don’t have too many stocks in your portfolio. 10 is really the max for a regular investor holding a full time job. You have a life out there besides staring at daily tickers and watch your blood pressure rise too

Empower Rule 3) Don’t believe in a so-called balanced, diverse portfolio to even out your risk. Would you rather have 10 good stocks, or 5 good and 5 bad stocks?

Empwoer Rule 4) Cut losses early (whether you short or go long) and ride your winners, remembering to pull out some profits when the ride is a little too hot.

Empower Rule 5) It’s ok to cut losses aka “go-stan”. Why do you think your car has a reverse gear? You may not use your reverse gear very often but it’s there when you need it so you can live to charge successfully another day in 7th gear.

Empower Rule 6) Know how to use information in a systematic way to increase your probability of a rewarding trade

===================================================

I wish you my best and see you at our regular free investment outreach!

To reserve your seat, you can click the icon below.

Do continue to stay connected with Empower Advisory via our Facebook Page, for enriching updates.

My Best, Always

Douglas Chow

Founder / Empower Advisory

Share our postings, be our Facebook Ambassador and win prizes!

Sell in May, Go away? S’pore & US stock market – 10 Jun 2014

=========================================

=========================================

Ever heard of Sell in “May, Go away”? Often heard and read in the media and the investment circle, it is a theory that the period from November to April inclusive has stronger growth than the other months. Hence investors are advised to sell their stocks in May since stocks generally take a tumble and pick them back at a lower price a month later or more.

What is the theory behind this phenomenon? A lot of research has been done to understand this stock market behavior. Indeed, a study published in the American Economic Review in 2002 showed that returns on stock markets in 36 out of 37 countries studied from 1970 to 1998 were higher from November to April than in the May to October period. A more recent research found that the phenomenon did indeed exist for 1998 to 2012 for major stock markets.

What could be the reason? Fund managers and individuals liquidating their positions so that they can go for their summer holidays uninterrupted? More adverse major economic and political events that seem to take place between May to October period?

In the United States, individuals get their annual capital gains distributions of mutual funds in November, and a month later, Christmas and year-end bonuses. So perhaps there is some palatable reasons why the stock market experience stronger growth between November to April. As for Singapore, maybe it takes its cue from the major stock markets and fall in line too.

But did it happen in 2014?

A quick look at the Dow Jones, Nasdaq and Straits Times index tell us that the “Sell in May, Go Away” effect did not happen, at least not for 2014. All 3 indices ended higher at the end of May than the start of the month. Some of our favourite stocks like Apple, Goodpack and Silverlake Axis continued their onward march. The takeaway is that you need to know what you are doing. Looking away just because you think everyone is dumping stocks in May means you have just missed making an early bonus for yourself.

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

SHARES

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

A tale of 2 Stock Markets (US vs SG) – 11 Jan 2014

=========================================================

2014 will be yet another exciting year for stock investments and good profits. No doubt the markets will be volatile and choppy and once again fraught with uncertainty with the certain tempered winding down of the US stimulus programme and the most likely scenario of a global rise in interest rate.

Sounds scary? But wasn’t 2013 also a wild yet profitable ride too? It also depends on which markets you are looking at. Let’s take a trip down memory lane and compare how the general Singapore stock market (represented by the STI) performed vis-a-vas the general US stock market for the whole year of 2013.

The Straits Times Index (STI) is regarded as the benchmark index for the Singapore stock market. It tracks the performance of the top 30 companies such as Starhub and DBS Group Holdings listed on the Singapore Exchange

The Dow Jones Industrial Average consists of 30 major American companies such as Coca Cola, MacDonalds, IBM and Intel. These companies come from a variety of industries. Do not misunderstand that this index only covers heavy industrial companies

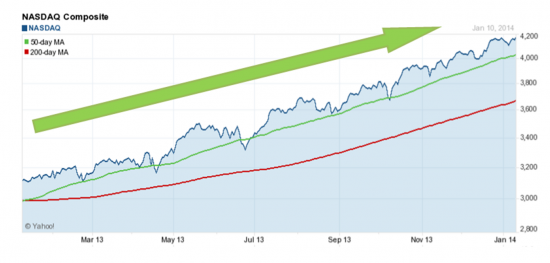

The NASDAQ Composite is a stock market index of over 3000 common stocks and similar securities listed on the NASDAQ stock market. Some of the composite stocks are Apple and Facebook. This index is taken to largely represent the stock performance of technology companies and growth companies

What do you see and interpret?

While it doesn’t mean that you can simply make money by blindly choosing any stock in the US market and comfort yourself by saying a rising tide lifts all ships, it means that markets in different countries perform differently and give you different rewards. In this light, it is also useful to consider buying a simple exchange traded fund that track the general performance of the various stock market indicators. Yes, very boring but profitable.

We have said it before and we’ll say it again. If you have been always looking at the Singapore market and are somewhat disappointed, do consider the US stock market which has great companies and tremendous trading volume.

Recently, we took a position in Tesla after doing our homework and applying the principles we teach at our course. If you recall, we covered Tesla in our superblog posting.

We look forward to welcome our 3rd batch of Empower Advisory members this 18 January and teach a life-skill worth many, many times the course fee!

Our Best, Always!

Here comes the panic at the Disco – 20 Jun 2013

==================================================================================================================================================

Is the party finally over? Today, the Singapore stock market fell 2.5%, the biggest daily decline in more than 19 months in line with weakening global markets after US FED Chairman Bernanke hinted strongly that US economic stimulus will end by next year, indicating an eventual rise in interest rate level.

It’s actually good news since it means that the US economy is in better shape and Bernanke is removing the economic powerhouse from its crutches. Why then are global markets panicking? Well, nobody likes interest rates to go up especially since global economic growth is uneven with some countries even stuck in technical recession. Nevertheless, markets are once again spooked and it may be time to look for an attractive entry point.

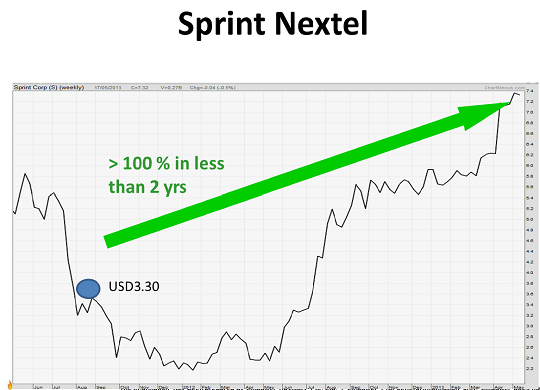

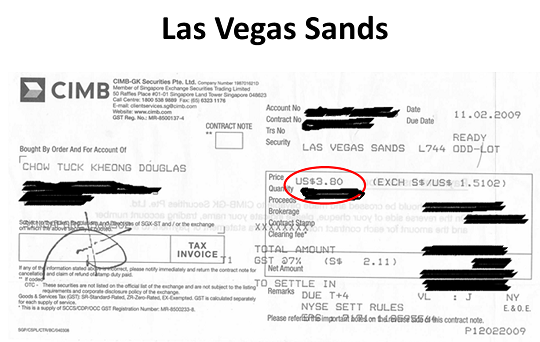

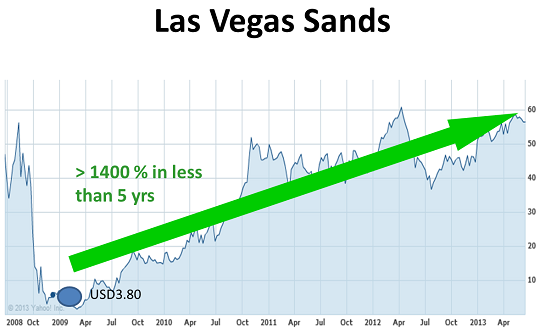

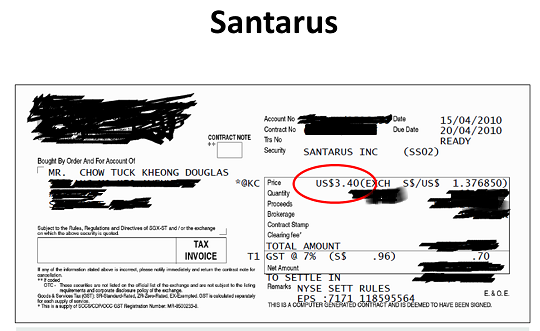

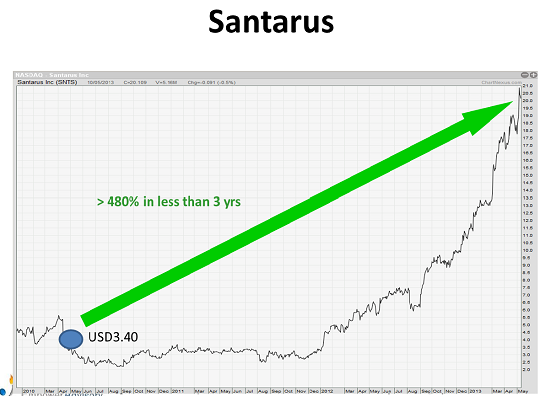

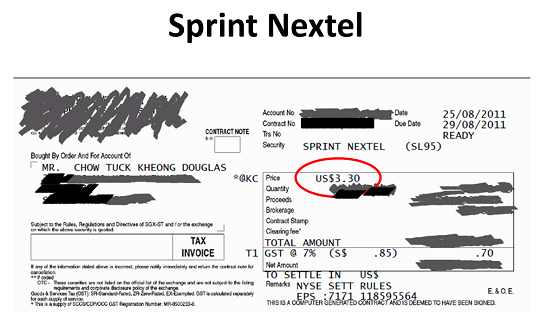

Below are the entry levels of some of my investments over the years which have benefited from panicky markets. I have no intention to show off. They are just to illustrate that multi-baggers with good companies are possible if you can sniff them out. At the seminar, I will share more of such positions with you!

Our best, always!