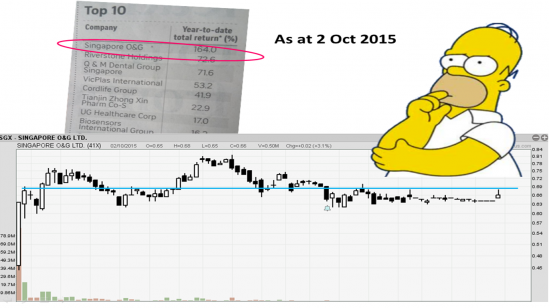

The amazing 164% returns of Singapore O&G – 5 Oct 2015

I was pleasantly surprised to read in the Straits Times on 5th Oct that Singapore O&G, medical practitioners in women’s healthcare – Obstetrics and Gynaecology (“O&G”) field which listed on the Catalist on 4th June has returned a whopping 164% to date, closing at 66 cents on 2 Oct 2015. This company is one of the listed healthcare related companies that the Straits Times deemed to have gone against the trend of the overall market downturn.

How did Singapore O&G pull off such a stunning performance? I decided to dig further and realized the 164% return was calculated from its IPO price of 25 cents.

Singapore O&G share price surged up upon its IPO debut and closed at 63.5 cents. So if you were to compare its first day closing price to its most recent close price of 66 cents, it’s not so spectacular after all. The increase over 4 months is less than 5%.

However, if you were to chart its share price, it is not exactly the ascending pattern that you might have expected. So who actually benefited from the 164% increase?

The bulk of the beneficiaries are folks who got placement shares ahead of the public. They got 41.4 million placement shares. Who are these lucky by-invitation-only folks? They are most probably friends of the directors of Singapore O&G and special clients of brokerages. They paid a total of $10.35 m for the placement shares. As for the public, only 2.2 million shares were made available to them for balloting and the amount raised was a paltry $550,000. As for the directors/founding shareholders of the company, their issued share price was as low as 2 cents. They are the biggest winners of course.

Why set an IPO price of only 25 cents? Setting an IPO price low enough to pop in price on a company’s trading debut rewards placement shareholders who can sell the shares instantly at a fantastic profit. If the company directors/founding shareholders are not locked in with selling restrictions, they too will be able to cash out handsomely. A pop will also provide free media coverage as reporters will be scrambling to cover Singapore O&G’s stunning Catalist debut.

Are there no losers?

If you look at the price chart of Singapore O&G, you’ll see that the stock is actually pretty much trading sideway. It hasn’t been sky-rocketing like what the eye catching table might have suggested. Many folks have bought at prices beyond 66 cents (See candlesticks above the blue line) and will feel no joy. Were they overly enthralled by Singapore O&G stunning debut? Some are staring at up to 23% loss, paper or realized. This company is not consistently traded. Some days, the number of shares traded is less than 500. On 29 Sep 15, no shares changed hand.

No doubt, after people read the exciting table in today’s Straits Times, some will simple punt several thousand dollars and more on Singapore O&G to hopefully ride another 164%. Will a whooper return materialise?

The takeaway is to be discerning with what you read, beyond glossy headlines. Be savvy enough to analyse the business of the company you are investing in and its stock behaviour. I also hope you now understand some of the motivation behind the “low” pricing of IPO shares.

Our Best, Always

See you at our regular free investment outreach!

To reserve your seat (date to be confirmed for 2016), you can click the icon below.

Do continue to stay connected with Empower Advisory via our Facebook Page, for enriching updates.

Our Best, Always

Empower Advisory

Share our postings, be our Facebook Ambassador and win prizes!

Taking over the Singapore Flyer – Good Decision? – 30 Aug 2014

What happens when a company’s decision does not go down well with its shareholders and analysts?

Shareholders dump the shares, causing the share price to come down.

This is exactly what happened to Straco Corp’s share price when it announced on 28th Aug 2014 that it had agreed to purchase the troubled Singapore flyer for $140 million in a 90:10 joint venture, with WTS Leisure Pte. Ltd’s taking the smaller stake.

Shareholders and analysts were not optimistic that Straco Corp could turn around the flagging business of the Singapore Flyer. They think that the cash that they would have to use for the purchase could be better used elsewhere to generate better returns. They think the price paid for the Singapore Flyer is too high. They don’t like the additional debt that Straco Corp would have to take to fund this purchase.

The next day, the share price of Straco Corp plunged more than 10% to $0.725 before recovering some lost ground to close at $0.785, 4.3% below its previous day closing price of $0.82.

Nothing in charting could have prepared you for the drop in Straco Corp’s share price. Just because you’re a fan of the Singapore Flyer does not mean the market will agree with you. But now you know the reason why Straco Corp’s share price dropped. Charts don’t explain the story. Fundamentally, events, sentiments and opinions drive how the charts move. The question now is, if you’re invested in Straco Corp, do you hang on, or offload?

Our Best, Always

Empower Advisory Team

Share our postings, be our Facebook Ambassador and win prizes!

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

Get READY! SGX to cut lot size from 19 Jan – 26 Aug 2014

You no longer have to find yourself priced out of more expensive blue chip stocks like Keppel Corp, DBS and UOB.

No need to shell out $11,000 just to own a piece of Keppel Corp. You will soon be able to have a tiny-weeny piece of this marine, property and infrastructure company at $1,100.

From 19 Jan 15, the trading volume of blue chips will shoot up many, many folds, shaking the sleepiness from some of these blue chip stiocks. With more trading activity, the greater the opportunity of profiteering, but only if you know how. What would you do now?

If you’re not well-versed in stock investment yet, get up to speed and equip yourself with REAL investment kung fu. Empower Advisory’s bi-monthly intensive stock investment course specifically prepares you for it. Just 2 more dates for Sep and Nov 14.

No nonsense, no games, no time wasting, no rah-rah. Because at Empower Advisory we teach, not trick.

To check out SPECIAL pricing for our September course (7th intake), scroll all the way to the bottom at this link.

Our Best, Always

Empower Advisory Team

Share our postings, be our Facebook Ambassador and win prizes!

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

Cheap can get cheaper (Case Study) – 5 Aug 2014

=============================================

I was driving today when I heard on the radio that Xpress Holdings Pte Ltd (“Xpress”) is in talks with UOB to avert a winding up application.

UOB is not the only one pressing Xpress for late payments. HSBC Institutional TrustServices (Singapore) and ASEAN Finance Corporation Ltd (AFC) are also in the fray. The sum owed is not a lot, just $2.4 million. That Xpress, a listed company on SGX Mainboard cannot pay up shows how weak the company is.

Isn’t it ironic that Xpress, a company that prints time-sensitive & quick turn around. publications such as stock market research reports , annual reports, IPO prospectuses, shareholder circulars and fund management reports cannot print its own report of stellar results?

An acquaintance called up. Let’s call him Cheapo since he has a clandestine affair with cheap penny stocks, despite having got burnt several times.

The conversation went something like this.

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

“Douglas, you saved me some serious money.”

“I know. So when you buying me lunch?”

“How did you know it will get that bad? The charts don’t show it?

“The signs were there but the charts can’t tell you. You don’t bother going through the financial numbers and thinking about the business model.”

“Aiyah, I too busy, ah.”

“Busy with work or busy with losing money?”

“Don’t rub it in, leh.”

“The charts can only tell so much. You like to buy cheap stocks. But cheap can become cheaper until one day you don’t even have a currency to represent your stock price. How much was it when you yakked about Xpress last year?”

“About 3 cents.”

“Today?”

“1.6 cents.”

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

The Takeway. Combine fundamentals with technical analysis in stock investment. That’s what we do at Empower Advisory. It will save you lots of tears. And it’s not rocket science. You can pick it up, just like all our course participants with or without financial background. Think about it. You can be either busy losing money and making excuses or busy making good investment decisions.

Douglas

Share our postings, be our Facebook Ambassador and win prizes!

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

How New SGX Regulations Will Affect You – 4 Aug 2014

=============================================================

We have distilled the latest SGX Regulations announced on 1 Aug 14 and highlight the salient ones that will affect you, the retail investor

Upcoming Changes in Singapore Stock Market Regulations that will affect you.

A minimum trading price of S$0.20 as a continuing listing requirement for company shares listed on the SGX Mainboard – While this tries to address risks of low-priced securities being susceptible to speculation and manipulation, it doesn’t mean that you can assume it will no longer happen. Most affected companies are likely to consolidate their shares so that their share price is well and above S$0.20 unless they can boost their share price organically through good financial performance. Expected date of implementation: Mar 2015. Companies will have up to 4 years from Mar 2015 to comply. Companies that don’t comply may be forced to delist.

1) Minimum price as a continuing listing requirement for company shares listed ONLY on the SGX Mainboard

2) More cash outlay required

Securities intermediaries like your brokerages houses will have to collect at least 5% of collateral from you for trading of listed company shares. Exempted from this rule are institutional investors (Big boys, not you and us), trades settled through delivery-versus-payment mode, and funds from the Central Provident Fund and Supplementary Retirement Schemes.

For those affected, you will have to keep cash collateral in trust accounts with licensed banks in Singapore at all times, except for cash collateral collected in relation to trades on overseas securities exchanges such as NASDAQ.

Expected date of implementation: Mid 2016

3) Expensive stocks become “cheaper” to buy

SGX will reduce the board lot size for securities listed on SGX from the existing 1,000 shares to 100 shares.

Expected date of implementation: Jan 2015. More details will be provided by end August 2014.

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

* Download “Empower Advisory” App on your mobile phone/device to get INSTANT Updates on Deals, Events and More!

* Simply Scan the QR Code on the left using your mobile phone, follow the link and install the App!

* If you are already accessing this page on your mobile phone, click on the QR Code, follow the link and install the App !

Clever Stock Investment (An Update) – 20 Mar 2014

========================================================

========================================================

1) Remember our posting on a Company we love, Goodpack Limited (“Goodpack”) back in 19 September 2013 (6 mths ago)? Well here’s a happy update for those who followed our call.

2) Goodpack is currently in talks with interested parties who might want to buy a major stake in the company or swallow it up whole. It’s anyone’s guess if it will really happen but based on that official announcement, Goodpack shares have shot up to $2.26, over its 19 Sep 2013 price of 1.74. For those who jumped onto the bandwagon, albeit later than us, it’s a pretty decent 30% returns (not including the 5 cents dividends announced in Dec 13) in 6 months. Which property investment can give you that?

3) That you make investments in stocks of quality companies cannot be over-emphasised. A quality company will attract corporate buyers and if Goodpack is taken private and delisted, it’s a good day for shareholders who can cash out now or later. What is bittersweet then is that they have to look elsewhere for other good companies. No worries, they are everywhere! You just need to know where to look.

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

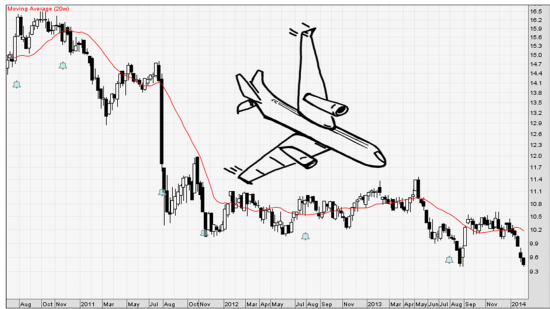

Just buy blue chip stocks and hold, hold, hold? – 10 Feb 2014

Singapore Airlines (SIA) stock performance from Oct 2010 to date

====================================================================

Some people use Warren Buffet’s name or his famous surname (Did they even get his permission??) to sell you the advice to follow what he is known to do – buy the stocks of blue chip companies and hold, hold, hold.

Hang on for a moment. Just for the records, Warren Buffet is not an ordinary retail investor. He takes so much stake in a company each time he takes a position, that he or his representative gets at least a board seat to influence the company’s strategic direction where necessary. With his deep industry connections, he helps the company to reverse its fortune or further expand its business and profitability.

You, the retail investor will not be able to do what Warren Buffet does. And if you only hear one side of the story and just blindly, hold, hold, hold on to blue chips stocks like Singapore Airlines (SIA), you’ll be a very angry and disappointed investor. Since October 2010 (see above chart), SIA has never recovered from its share price of $16 and is trading at about $9.50 today.

For a company that used to make $1b in annual profits pretty effortlessly, it is now struggling to make more than $500m, unable to grow its topline meaningfully and having to contend with overcapacity, higher operating cost and intense competition as rival full fledged and budget airlines catch up. It is a blue-black company today. Its profit margins these days are less than 5%, a far cry from its glory days.

Hanging like a dead weight around its neck is SIA’s stake in Tiger Airway which is doing badly too. The lesson here is knowing how and when to cut losses to reinvest in more profitable stocks. Having good money locked in for 3 years at a loss is a grand pity when one can use the salvaged funds to ride on other good company stocks. What’s worse is that you don’t even get a board seat in SIA to air your grievances despite being a loyal SIA stockholder!

Our Best, Always!

Share our postings, be our Facebook Ambassador and win prizes!

SHARES

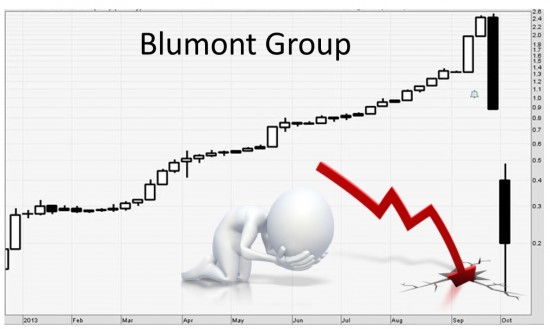

From stock zero to stock hero and back again -10 Oct 2013

=========================================

If not for Blumont Group making the news because of its spectacular fall from a Thursday’s close (3 Oct 12) of S$2.02 to 88 cents and finally to 13 cents the following Monday, we wouldn’t have known about the existence of this company listed on SGX.

What business is this company actually all about? How could it lose more than 90% in value in the space of a few days? Did the earth open up and swallow its business and employees?

A quick check on this company revealed that it has three core business segments including Investment Holding, Sterilisation and Property. Since the start of 2013, it made exuberant announcements of forays into the energy sector specifically in Iron Ore, Thermal and Coking Coal, Coking Coal, Gold and Uranium and Copper through a series of sales and purchase agreements. Imagination manifested into hopeful optimism and rocketed what was a down-beaten illiquid 3 cents penny stock back in 2012.

Those who have hopped on the bandwagon early in the stock advance, would have won bragging rights of snagging a multi-bagger. Good for you and we hope you had locked in your profits before the share price meltdown. If not, you’re almost back to square one. Those left carrying the ball after the stock price plummeted will definitely feel angry and lost. Why would Blumont not even figure on our radar? Its most recent 2Q 2013 results revealed a loss of SGD24m. Yet when this was announced on 29 July 2013, the stock continued to rocket from 94 cents to a peak of $2.54, no doubt partly on the buzz of the company’s positive announcements (no actualized profits yet). The ever ascending candlestick stock price chart with nary a break if you noticed, looked unreal to us. All in all, there are more questions than answers regarding the stock’s quick ascent and even faster collapse. SGX is currently investigating.

There are many good stocks with real underlying business and positive financials. Just yesterday, we longed a logistic company stock at 10.3 cents and are up 2% the next day by combining our usual blend of fundamental analysis with technical indicators. And yes, we are having a good night sleep over our latest investment!

Our Best, Always!

Why we bought Goodpack Limited’s shares – 19 Sep 2013

==========================================================

To Empower Advisory, investing in stocks, is about understanding the underlying company, what it does and how good it does what it is supposed to do. Take Singapore listed Goodpack Ltd for example. It was part of a list of our regular stock alert to our members.

Goodpack has a unique logistic business of owning and renting out a very large fleet of over 2.6 million steel Intermediate Bulk Containers (IBC) to transport their customers’ goods in a more efficient and cost effective way than the use of wood and corrugated packaging that is usually used one time and disposed. The IBCs are robust and specially designed to minimize damage to the goods during transportation. That is why companies who ship high value and high margin products such as automotive parts and chemicals engage Goodpack and are willing to pay a premium for its service. Ask yourself. If you are transporting premium automotive parts worth $50,000, would you risk damage using a cheaper transport solution like a typical wooden crate?

That is why we agree with Goodpack’s business. Superior delivery solution for premium clients with high value goods that require more protection and care.

The financial performance of Goodpack speaks for itself. Since 2004, the company has consistently registered net profit margin of more than 25%, BETTER than most listed companies in SGX! It has a good sensible management that is focused on business growth, has strong operating cash flow, a strong balance sheet and has chalked year on year revenue growth since 2005.

To walk the talk, I entered at S$1.52 about 1 and 1/2 mths ago and I’m up 15% today.

We highlight good companies to our members and they apply what they have learnt in our course to profit.

Empower Advisory is about real learning. That is what our Course is all about.

No scams. No nonsense.

Our Best, Always!