A tale of 2 Stock Markets (US vs SG) – 11 Jan 2014

=========================================================

2014 will be yet another exciting year for stock investments and good profits. No doubt the markets will be volatile and choppy and once again fraught with uncertainty with the certain tempered winding down of the US stimulus programme and the most likely scenario of a global rise in interest rate.

Sounds scary? But wasn’t 2013 also a wild yet profitable ride too? It also depends on which markets you are looking at. Let’s take a trip down memory lane and compare how the general Singapore stock market (represented by the STI) performed vis-a-vas the general US stock market for the whole year of 2013.

The Straits Times Index (STI) is regarded as the benchmark index for the Singapore stock market. It tracks the performance of the top 30 companies such as Starhub and DBS Group Holdings listed on the Singapore Exchange

The Dow Jones Industrial Average consists of 30 major American companies such as Coca Cola, MacDonalds, IBM and Intel. These companies come from a variety of industries. Do not misunderstand that this index only covers heavy industrial companies

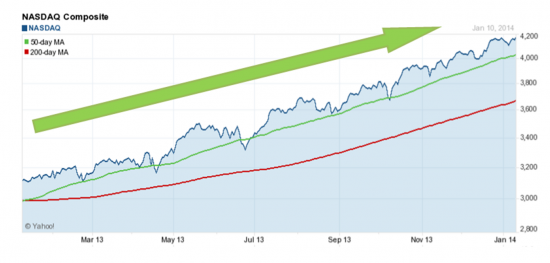

The NASDAQ Composite is a stock market index of over 3000 common stocks and similar securities listed on the NASDAQ stock market. Some of the composite stocks are Apple and Facebook. This index is taken to largely represent the stock performance of technology companies and growth companies

What do you see and interpret?

While it doesn’t mean that you can simply make money by blindly choosing any stock in the US market and comfort yourself by saying a rising tide lifts all ships, it means that markets in different countries perform differently and give you different rewards. In this light, it is also useful to consider buying a simple exchange traded fund that track the general performance of the various stock market indicators. Yes, very boring but profitable.

We have said it before and we’ll say it again. If you have been always looking at the Singapore market and are somewhat disappointed, do consider the US stock market which has great companies and tremendous trading volume.

Recently, we took a position in Tesla after doing our homework and applying the principles we teach at our course. If you recall, we covered Tesla in our superblog posting.

We look forward to welcome our 3rd batch of Empower Advisory members this 18 January and teach a life-skill worth many, many times the course fee!

Our Best, Always!