Here comes the panic at the Disco – 20 Jun 2013

==================================================================================================================================================

Is the party finally over? Today, the Singapore stock market fell 2.5%, the biggest daily decline in more than 19 months in line with weakening global markets after US FED Chairman Bernanke hinted strongly that US economic stimulus will end by next year, indicating an eventual rise in interest rate level.

It’s actually good news since it means that the US economy is in better shape and Bernanke is removing the economic powerhouse from its crutches. Why then are global markets panicking? Well, nobody likes interest rates to go up especially since global economic growth is uneven with some countries even stuck in technical recession. Nevertheless, markets are once again spooked and it may be time to look for an attractive entry point.

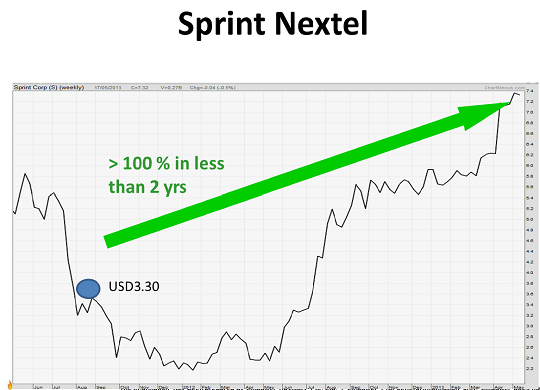

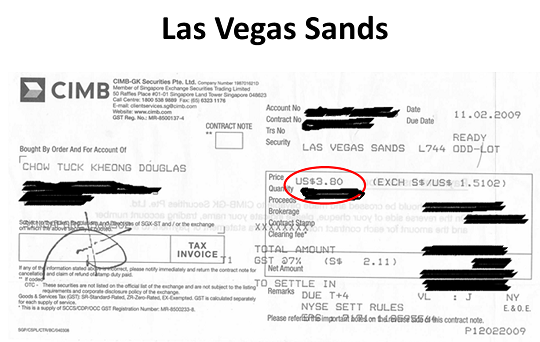

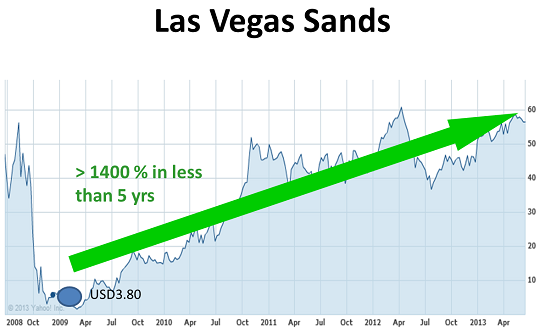

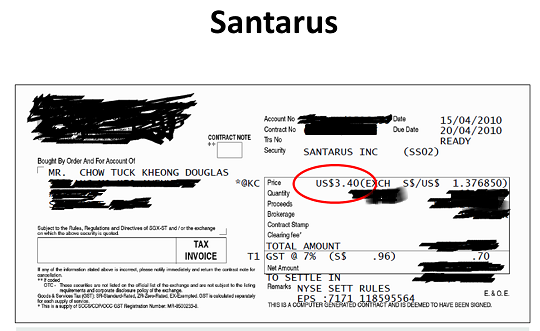

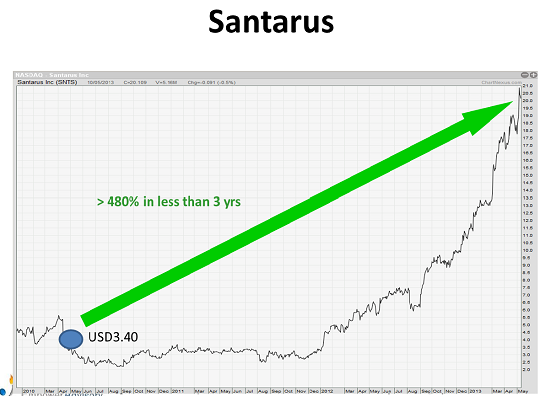

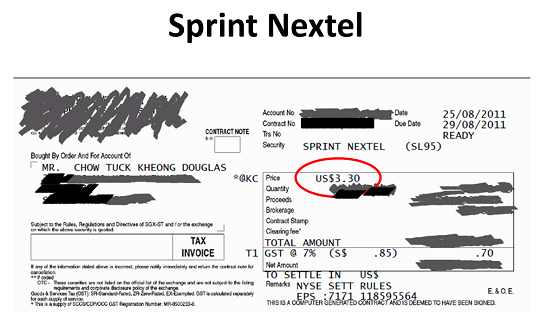

Below are the entry levels of some of my investments over the years which have benefited from panicky markets. I have no intention to show off. They are just to illustrate that multi-baggers with good companies are possible if you can sniff them out. At the seminar, I will share more of such positions with you!

Our best, always!

Google – did you miss its amazing trajectory? – 7 Jun 2013

Oh, Google. What else can I say about this innovative company that has sunk deep root in our lives through its plethora of products offering like Youtube, the android operating system for smartphones, cloud software, Google maps and voice navigation, Nexus tablets, Google glasses and even a futuristic driverless car? It is little wonder why its share price has rocketed more than 800% since it IPOed at USD85 back in 2004. Today it hovers near the USD900 mark as the chart below shows.

For a company that included in their 2004 IPO prospectus that “We believe strongly that in the long term, we will be better served—as shareholders and in all other ways—by a company that does good things for the world even if we forgo some short term gains”, it has reaped for itself and its shareholders wonderful rewards indeed.

Google is one of many examples that I use to illustrate to folks that one must understand how a stock is valued and it doesn’t mean that just because a stock appear expensive, its potential for upside is limited. From my observation, many people like the idea of buying penny stocks worth a few cents thinking that they can easily double or triple in value. What they fail to understand is that when a stock trade near the value of zero, it is usually because the company is struggling, or worse still, on the verge of closure. I have learnt my lesson dabbling in local penny stocks such as Digiland and it has taught me a good lesson. The white knight (back-door listing) that we hope to come to the rescue of a penny stock is often a mirage. Penny stocks are also a playground for manipulative trading forces to churn up trading volume and suck in the clueless. Don’t risk your hard earned money on speculative penny stocks. There are many wonderful companies like Google, with sound fundamentals and global products. All you have to do is look around you conscientiously! Our course will show you how to identify these gems!

Our best, as always.

Fundamental Analysis vs Technical Analysis – 1 Jun 2013

I’ve always been asked which side I lean towards; fundamental analysis or technical analysis?

Fundamental analysis of a stock means looking at the business’ financial health, its growth numbers, its management, its business model and its competitive standing. You need to be alert for any such information pertaining to the company you are already invested in or going to take a position (long or short). When applied to futures and forex, it means you have a good understanding of the competitiveness of economies, industrial production numbers and employment data among other macro-level economic data.

Technical analysis is about forecasting the direction of stock prices through the study of market data charts, primarily price and volume. Often, a hardcore chartist would dismiss fundamental analysis as a waste of time, arguing that all there is to know about the company is already priced in and reflected in the company share price and movement. One just need to interpret the charts to make money.

I beg to differ. Both are equally important. Fundamental analysis helps me to sleep at night even when my stock price swings, for I’m assured that I have invested in a quality company. Technical analysis helps me to time my entry into the stock so that I do not buy in at too high a price or sell at too low a price. Combining both is the best approach. To find out how, come to our course!

Our best, always.